- KDDI HOME

Corporate Information

Corporate Information  Investor Relations

Investor Relations  Corporate Governance

Corporate Governance  Framework, etc.

Framework, etc.

Framework, etc.

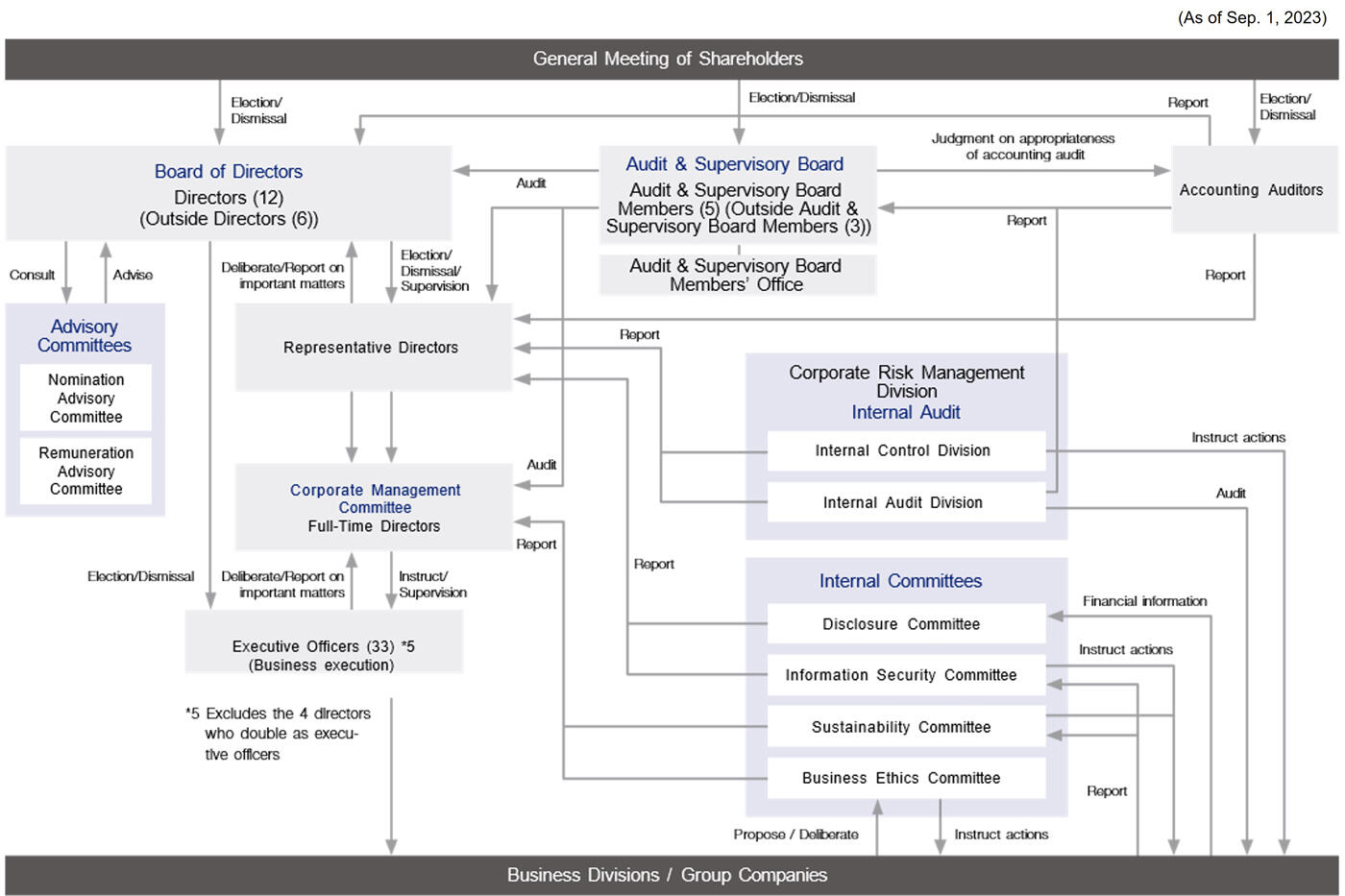

Corporate Governance Framework (As of September 1, 2023)

1Board of Directors

At KDDI, Board of Directors resolutions determine:

- Matters prescribed by the Companies Act or other laws and regulations

- Matters prescribed by the Articles of Incorporation

- Matters delegated for resolution at the general shareholder meeting, and

- Other important management-related matters.

For other important management-related matters, their importance is determined according to such factors as the scale of money, business, assets, and investment involved.

The Board is composed of directors, including outside directors and independent outside directors. The Board of Directors reaches decisions on a variety of issues, including business plans and important matters outlined in laws and regulations. The Board also conducts supervision in an effort to ensure directors appropriately fulfill their work obligations.

2Advisory Committee

KDDI has formed a Nomination Advisory Committee and a Remuneration Advisory Committee to discuss with and provide advice to the Board of Directors to maintain both transparency and objectivity on the system of nomination of executive candidates and Audit & Supervisory Board member candidates and the level of remuneration for executives.

The Chairman, Vice Chairman and half or more of the members of these committees are outside directors.

3Corporate Management Committee

Comprised of internal directors, executive officers and others, the Corporate Management Committee deliberates and decides on important matters related to business execution at the Company and its subsidiaries.

4Audit & Supervisory Board/Audit & Supervisory Board Members

Audit & Supervisory Board members conduct their audit work based on audit policies and plans established by the Audit & Supervisory Board, and carry out their work by attending meetings of the Board of Directors, the Corporate Management Committee, and other major internal meetings. The Audit & Supervisory Board receives reports on the audit methods of Audit & Supervisory Board members and their results, discusses them, and offers its opinions, as appropriate, at meetings of the Board of Directors.

5Internal Audit

KDDI conducts periodic internal audits targeting all the operations of the Group, and regularly reviews the appropriateness and effectiveness of internal controls.

The results of these internal audits are reported to the president and the Audit & Supervisory Board members, along with recommendations for improvement and correction of any problems.

6Internal Committees

- KDDI Group Business Ethics Committee: deliberates and makes decisions on compliance-related items for the Group

- Disclosure Committee: deliberates on financial results information to be disclosed at fiscal period-ends

- Sustainability Committee: This committee deliberates on sustainability-related matters such as solving social issues (SDGs), social contribution , and the environment through business.

- Information Security Committee: ensures overall information security regarding information assets

Organizational Form

Company with an Audit & Supervisory Board

Policy and Procedure for the nomination of Director and Audit & Supervisory Board member candidates by the Board of Directors

Accepting the diversity of human resources and utilizing the diverse knowledge, experiences, and skills of each employee are important drivers of growth for the Company that aims for the "Integration of Telecommunications and Life Design," and we believe that ensuring diversity in the Board of Directors will also lead to good management decisions.

The Company believes that the overall Board of Directors should include members with advanced specialized knowledge and diverse perspectives when making decisions including matters that are important from a management perspective and matters that legally require supervision. Accordingly, in principle the board includes the following members.

(Standards of Nomination and Election)

Director Candidates

- People with specialized knowledge and experience in various fields of business

- People who have management knowledge appropriate to a supervisor or possess specialized knowledge

- People who are highly independent

Audit & Supervisory Board Member Candidates

People who are able to supervise overall management from a perspective independent from directors and who have the extensive experience and broad-ranging insight to enhance audit appropriateness.

All Candidates

People who have no selfish and high ethical view and personality appropriate to an executive member

Nomination and Election Procedures for Directors

[1] Select candidates based on the above criteria

[2] Deliberate them at a Nomination Advisory Committee

[3] Approve them at a Board of Directors

[4] Elect them at the Annual Shareholders Meeting

Nomination and Election Procedures for Audit & Supervisory Board Members

[1] Select candidates based on the left criteria

[2] Deliberate them at a Nomination Advisory Committee meeting

[3] Gain approval from the Audit & Supervisory Board

[4] Approve them at a Board of Directors meeting

[5] Elect them at the Annual Shareholders Meeting

Consideration Criteria for Termination

- When the performance of a business that a director is responsible for or the achievements of a department a director is responsible for are exceptionally poor

- When the company is harmed by a major misstep or intentional violation of a law, regulation or the Articles of Incorporation in their execution of duties

- When the company's credibility and reputation are significantly damaged by the inappropriate seeking of personal gain through the abuse of position or authority

- When the company determines that keeping a director is not appropriate

Termination Procedures for Directors

- After deliberations at the Nomination Advisory Committee meeting, the Board of Directors deliberates the matter as needed and implements necessary measures for termination

Succession Plan

- With regard to candidates for successors to the President and other positions, in order to continue the sustainable growth of our corporate value, we seek to secure successor candidates who can respond to changes in the business environment, accelerate changes in the social environment due to global conditions, and who can take responsibility for realizing KDDI Mid-Term Management Strategy and KDDI VISION 2030 for the Company. To achieve this, we ensure the diversity of our candidates through a wide range of work experience and placement in key positions to promote Developing Human Resources that will enable the appointment of personnel with personality, managerial or professional knowledge and experience.

The Board of Directors decides on the appointment of candidates after reviewing them during the Board of Directors meetings and through deliberations by a Nomination Advisory Committee. The composition of the committee includes the Chairman, Vice Chairman, and at least half of the members being Independent Directors. - Future candidates for management executive positions are selected regardless of age, gender, expertise, or field of experience and are systematically trained through programs such as the "KDDI Business Cram School," a management training program for executive candidates, and the "Executive Assistant System," etc.

Evaluation Results

Summary

The evaluation confirmed that KDDI's Board of Directors is operating properly and functioning effectively. The following two points received particular praise:

- The Board of Directors is managed by leveraging the knowledge of outside directors/Audit & Supervisory Board Members with various backgrounds.

Board of Directors' meetings have been operated in an open atmosphere with lively discussions among members, where outside directors/Audit & Supervisory Board Members are willing to express their opinions.

In addition, executive officers provide appropriate explanations and responses to comments and suggestions that outside directors/Audit & Supervisory Board Members make based on their respective expertise. - Efforts to enhance discussions at Board of Directors' meetings

Information necessary for a discussion is properly summarized and presented so that discussion points are made clear.

In addition, for important issues such as mergers and acquisitions, information is provided to directors so that they exchange opinions in advance through off-site meetings, etc., which helps improve the Board of Directors' supervision function.

Future issues

- Further enhancing group governance

Based on the lessons learned from the previous event, the Company has been engaging in efforts, including creating a support division as well as establishing a monitoring system. The Company will further strengthen the group governance by regularly reporting, sharing, and supervising the progress and challenges of these projects. - Enhancing discussions on key topics from a perspective of improving corporate value over the medium to long term.

Each director and Audit & Supervisory Board Member has suggested various topics to be discussed, including medium- to long-term growth strategies and key non-financial topics.

Board of Directors will pick up those topics regularly at Board of Directors' meetings and off-site meetings and discuss them broadly with outside directors/Audit & Supervisory Board Members to try to make the Board of Directors' functions more effective.

Moving Forward

Through proactive initiatives based on the "Satellite Growth Strategy" with telecommunications at its core, KDDI continues to diversify its business domains and expand its business scale through an increase in the number of group companies.

In this environment, we believe that in order for the KDDI Group to fulfill its social responsibilities and achieve sustainable growth while appropriately responding to various risks, it is important to further strengthen corporate governance, which serves as the foundation for such efforts.

The Group as a whole will strive to further disseminate the "KDDI Group Philosophy," which serves as the foundation of its corporate activities, as well as strengthen its governance system, including risk management, while enhancing the effectiveness of risk management through timely and appropriate supervision by the Board of Directors.

Principal Activities of Outside Directors and Outside Audit & Supervisory Board Members

| Name | Independent director |

Reason for selection |

|---|---|---|

| Goro Yamaguchi |

Goro Yamaguchi has a wealth of corporate management experience and excellent knowledge cultivated as the President and Representative Director of a major electronic components and equipment manufacturer. On the Board of Directors, the Company has received his broad opinions related to business administration and operations from a medium- to long-term perspective, and he has contributed to improving the corporate value of the Company. Going forward, the Company expects that he will contribute to the strengthening of the supervisory function for the execution of business and provide advice from a wide-ranging managerial perspective based on his management experience at other companies. Therefore, he has again been selected as a candidate for Outside Director. | |

| Keiji Yamamoto |

Keiji Yamamoto has excellent knowledge cultivated in IT development and electronics engineering divisions and abundant corporate management experience as a corporate manager at a major automobile manufacturer. On the Board of Directors, the Company has received his broad opinions on promoting 5G/IoT strategy, etc. from a medium- to longterm perspective, and he has contributed to improving the corporate value of the Company. Going forward, the Company expects that he will contribute to the strengthening of the supervisory function for the execution of business and provide advice from a technical perspective in the field of information and communications, etc. Therefore, he has again been selected as a candidate for Outside Director. |

|

| Shigeki Goto |

○ | Shigeki Goto has superior knowledge in telecommunications and network engineering, and information processing, which are directly relevant to the business of the Company, as well as in the field of cybersecurity that is crucial for its business operation. Although he has no direct experience in corporate management, on the Board of Directors, the Company has received his expert opinions related to the management policy as a telecommunications operator that provides social infrastructure, from a medium- to long-term perspective independent of the management team, and he has contributed to improving the corporate value of the Company. Going forward, the Company expects that he will contribute to the strengthening of the supervisory function for the execution of business and provide advice from his expert perspective in the information and communications field, etc. Therefore, he has again been selected as a candidate for Outside Director. Moreover, with this background we judge there to be no risk of a conflict of interest with general shareholders and accordingly he has again been nominated as Independent Director. |

| Tsutomu Tannowa |

○ | Tsutomu Tannowa has a wealth of corporate management experience cultivated as President & CEO of a major chemical manufacturer, as well as excellent knowledge from a global perspective. On the Board of Directors, the Company has received his contributions to strengthen the supervisory function for the execution of business based on his management experience at other companies and his broad opinions from a medium- to long-term perspective independent of the management team, and he has contributed to improving the corporate value of the Company. Going forward, the Company expects that he will contribute to the strengthening of the supervisory function for the execution of business and provide advice from a wide-ranging managerial perspective. Therefore, he has again been selected as a candidate for Outside Director. Moreover, with this background we judge there to be no risk of a conflict of interest with general shareholders and accordingly he has again been nominated as Independent Director. |

| Junko Okawa |

○ | Junko Okawa has a wealth of corporate management experience as a manager of a major airline company, in addition to excellent knowledge cultivated from her work experience at that airline company, especially in practical aspects such as customer service, corporate rehabilitation, and diversity promotion. On the Board of Directors, the Company has received her contributions to strengthen the supervisory function for the execution of business based on her management experience at other companies and her broad opinions from a medium- to long-term perspective independent of the management team, and she has contributed to improving the corporate value of the Company. Going forward, the Company expects that she will contribute to the strengthening of the supervisory function for the execution of business and provide advice from a wide-ranging managerial perspective. Therefore, she has again been selected as a candidate for Outside Director. Moreover, with this background we judge there to be no risk of a conflict of interest with general shareholders and accordingly she has again been nominated as Independent Director. |

| Kyoko Okumiya |

○ | Kyoko Okumiya has abundant experience and superior knowledge, cultivated as the partner at a law firm and a committee member of government committees. Although she has no direct experience in corporate management, she has been selected as a candidate for Outside Director because we judge that she will contribute to improving the Company's corporate value by providing expert opinions on legal risk management from a medium- to long-term perspective independent of the management team. Moreover, with this background we judge there to be no risk of a conflict of interest with general shareholders and accordingly she has been nominated as Independent Director. |

Outside Director/Auditor Support System

Board of Directors meeting dates and agenda items are provided in advance to Outside Directors and Part-time Outside Audit & Supervisory Board Members. In addition, agenda materials are distributed at least three business days prior to the meeting to foster understanding of the items in question and invigorate deliberations at Board of Directors meetings. Additionally, we accept questions in advance, and based on the content of these questions, we strive to enhance the content of explanations on the day of the Board of Directors meeting, thereby deepening substantive deliberations.

Information on business strategies, business conditions, R&D, and technology is also provided at places other than the Board of Directors meeting. Specifically, general managers and managers of each business division explain in detail the overall image and issues, and also regularly report on the business situation of the subsidiaries. In addition, the Company provides the opportunity to attend the social exhibition of the R&D results and to inspect the monitoring and maintenance center, the telecommunication facilities, etc. The Company also reports on business ethics and risk management activities twice a year.

Furthermore, in order to strengthen the ability of Outside Directors to gather information, they are invited to attend the Audit & Supervisory Board when the Audit Firm reports the results of the second quarterly review and the year-end audit, and liaison meetings with Audit & Supervisory Board Members are held twice a year.

Furthermore, liaison meetings only for Outside Directors are held to promote cooperation among Outside Directors; and liaison meetings between Outside Directors and Part-time Outside Audit & Supervisory Board Members are also held.

Through these activities, by deepening the understanding of KDDI's business, discussions on management strategies at the Board of Directors are accelerated and the effectiveness of management supervision is improved.

The Audit & Supervisory Board Members' Office has been established to assist all Audit & Supervisory Board Members, including Part-time Outside Audit & Supervisory Board Members, in their duties.

Policies on Parent and Subsidiary Listings

Okinawa Cellular Telephone Company (hereafter, "Okinawa Cellular"), one of our subsidiaries, is listed on the Tokyo Stock Exchange (TSE) Standard Market.

1. Significance of having a publicly listed subsidiary in light of group management concept and policy

2. Measures to ensure effectiveness of the governance system of a publicly listed subsidiary

With regard to the operation of Okinawa Cellular's business, an agreement on the following was concluded at the time of its establishment and since then it has been managed in compliance with the agreement.

- As a basic principle, Okinawa Cellular shall contribute to the realization of an affluent life for local people and to the promotion of the local economy by providing mobile phone services which are a very convenient, high-quality, and inexpensive means of information communication to a wider group of customers as a community-based business.

- We shall consider and implement various necessary measures in cooperation with Okinawa Cellular from the viewpoint of the development of the mobile phone business.

- Okinawa Cellular shall voluntarily manage the business in light of the actual situation of the local community.

For transactions that may cause a conflict of interest, Okinawa Cellular determines whether or not to conduct such transactions through a multifaceted discussion among independent outside directors and independent outside auditors. In addition, Okinawa Cellular has established a voluntary committee consisting mainly of outside directors which deliberates appointment and remuneration of directors as an advisory body of the Board of Directors. By determining the appointment and remuneration of the management through a discussion among Okinawa Cellular's independent directors as such, transparency is ensured.

In order to appropriately control conflicts of interest, directors who concurrently serve as directors of both the Company and Okinawa Cellular do not participate in any resolutions or deliberations on matters related to both parties, thereby ensuring independence.

While ensuring transparency in management from a viewpoint of protecting the benefits of minority shareholders through these efforts, we will respond to the expectations of our shareholders by improving our corporate value and shareholder return.

Going forward, we will continue to strive to develop as a group by managing business in cooperation with Okinawa Cellular while mutually respecting the independence and autonomy with it.

Policy on Strategic Shareholdings

KDDI believes that participating in tie-ups with a variety of companies is essential to providing our customers with increasingly diverse and advanced services.

KDDI possesses strategic shareholdings if such possession will contribute to the sustainable growth of KDDI's business and the medium to long-term increase of corporate value.

Every year, the Board of Directors reviews all the pros and cons of continuing the possession of each individual strategic holding by judging its significance and economic rationale. When a strategic shareholding is found to have only tenuous significance, we will sell as promptly as possible.

The Company calculates the ratio of the contribution by the issuing company to the Company's profits within the most recent fiscal year.

The economic rationale is verified by comparing the ratio with the valuation of each strategic shareholding at the end of the most recent fiscal year, and confirming whether the ratio satisfies the capital cost standard established by the Company.

Investor Relations

E-mail Alerts

- KDDI IR Official Twitter

- Recommended Contents

-