Corporate Governance

Basic Stance on Corporate Governance

KDDI considers strengthening corporate governance to be a vital issue in terms of enhancing corporate value for shareholders, and is working to improve management efficiency and transparency.

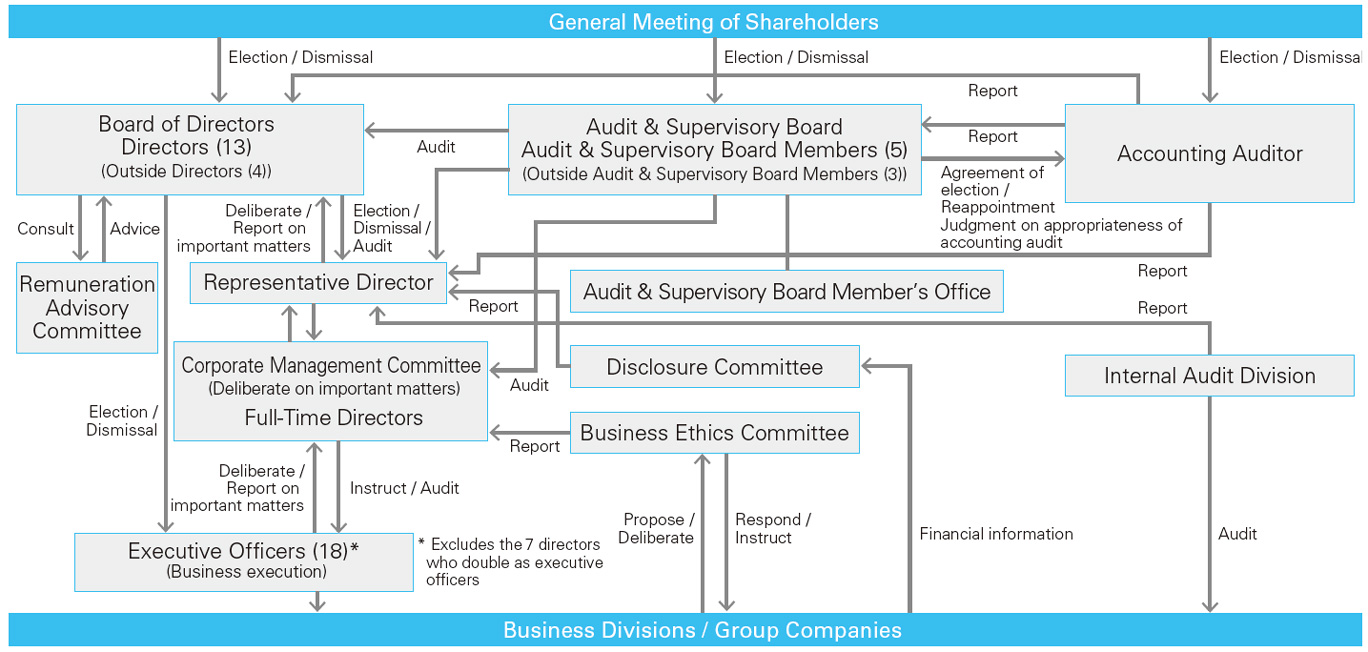

With regard to business execution, an executive officer system was introduced in June 2001 to assign authority, clarify responsibilities, and ensure that operations are conducted effectively and efficiently. The Company is also working to systematize internal decision-making flow with a view to ensuring timely management decisions.

KDDI is making active efforts to vitalize the Annual General Meeting of Shareholders and ensure smooth exercise of voting rights. Convocation announcements are issued early (the target being three weeks prior to the meeting), and the Company strives to avoid scheduling the meeting on days when many other companies hold their shareholders' meetings. KDDI also allows shareholders to exercise their voting rights via PC and mobile phone platforms.

The Board of Directors, which includes outside directors and independent outside directors, makes decisions regarding important matters as prescribed by relevant statutes, and oversees the execution of business by directors and other managers to ensure proper conduct.

The agenda items for the Board of Directors, as well as important matters relating to the execution of business, are decided by the Corporate Management Committee, composed of directors and executive officers. The Board of Directors also has the right to appoint and dismiss executive officers. Furthermore, we have established the Remuneration Advisory Committee to advise the Board of Directors on executive remuneration.

Auditors attend meetings of the Board of Directors, as well as other important internal meetings. The Board of Directors and the Internal Audit Division provide, in an appropriate and timely manner, all data necessary for the execution of auditors' duties, the exchange of opinions, and collaboration with auditors. The Board also periodically listens to reports from the accounting auditor on the annual accounting audit plan, progress, and the results of accounting audits. It also makes recommendations and conducts exchanges of opinions as necessary.

All KDDI Group operations are subject to internal audits to regularly assess the appropriateness and effectiveness of internal controls. The results of internal audits are reported to the president and to auditors, along with recommendations for improvement and correction of problem areas.

KDDI also has a Business Ethics Committee, which makes decisions on compliance-related issues, and a Disclosure Committee, which oversees disclosure of information. By bringing together the various systems and frameworks for managing each Group company, KDDI is working to enhance governance across the entire Group.

- Response to Japan's Corporate Governance Code

-

We understand the gist of the Corporate Governance Code to be that a company must be accountable to its stakeholders and be proactive in its corporate governance, ensuring that decision-making is transparent and fair, as well as swift and decisive.

Based on this understanding, KDDI engages in dialogue with its shareholders and other stakeholders, monitors public trends, and considers and responds to needs through optimal corporate governance.

Corporate Governance Framework (As of June 17, 2015)

Changes in the Corporate Governance Framework

Reasons for Appointment as Outside Executive Members

| Name | Reason for selection as an outside director of the Company (If designated as an independent director, reason for this designation) |

Principal activities in FY2014 |

|---|---|---|

| Tetsuo Kuba | Mr. Kuba was appointed because of his demonstrated effectiveness in the management of one of the Company's principal shareholders, his extensive experience as a director of other companies, and the perspective rooted in broad-based insight that he brings to supervising the Company's business activities. | Board of Directors' meetings Attended 8 of 8 meetings |

| Nobuyori Kodaira | Mr. Kodaira was appointed because of his demonstrated effectiveness in the management of one of the Company's principal shareholders, his extensive experience as a director and auditor of other companies, and the perspective rooted in broad-based insight that he brings to supervising the Company's business activities. | Board of Directors' meetings Attended 7 of 8 meetings |

| Shinji Fukukawa (Independent director) |

Mr. Fukukawa was appointed to apply the extensive experience and broad-based insight he has developed over numerous years as an executive officer in public administration and at various foundations involving the execution of operations at those organizations to supervising the Company's business activities. Given his career history, we judge that no danger exists of conflicts of interest with general shareholders, consider him appropriate as an director, and have appointed him as an independent director. | Board of Directors' meetings Attended 7 of 7 meetings |

| Kuniko Tanabe (Independent director) |

Although Ms. Tanabe has not been involved in company management as a director in the past, she was elected to incorporate the extensive experience and wide knowledge she has gained as a partner at a law office in the supervision of the Company's business activities. Given her career history, we judge that no danger exists of conflicts of interest with general shareholders, consider her appropriate as an director, and have appointed her as an independent director. |

- |

| Name | Reason for selection as an outside Audit & Supervisory Board member of the Company (If designated as an independent auditor, reason for this designation) |

Principal activities in FY2014 |

|---|---|---|

| Takeshi Abe (Independent auditor) |

Mr. Abe was appointed because of the extensive experience and broad-based insight he has developed over numerous years as an executive officer in public administration and at various foundations involving the execution of operations at those organizations. Consequently, he has been appointed to supervise overall management from a position independent from that of a director with the objective of promoting even more appropriate auditing. Mr. Abe's tenure as executive officer at the Development Bank of Japan, Inc., was short. A substantial amount of time has passed since he retired from that position, and he currently receives no benefits from that organization. Given this experience, and the fact that he hails primarily from organizations involved in administrative operations, we recognize that he has scant relationship with KDDI. Consequently, we judge that no danger exists of conflicts of interest with general shareholders, consider him appropriate as an auditor, and have appointed him as an independent auditor. | Board of Directors' meetings Attended 7 of 8 meetings Audit & Supervisory Board meetings Attended 7 of 8 meetings |

| Kishichiro Amae (Independent auditor) |

Mr. Amae has extensive experience gained through many years as a diplomat and in the execution of operations at various organizations, etc. Consequently, he has been appointed to supervise overall management from a position independent from that of a director with the objective of promoting even more appropriate auditing. Given his career history, we judge that no danger exists of conflicts of interest with general shareholders, consider him appropriate as an auditor, and have appointed him as an independent auditor. |

Board of Directors' meetings Attended 8 of 8 meetings Audit & Supervisory Board meetings Attended 8 of 8 meetings |

| Yukihisa Hirano (Independent auditor) |

Mr. Hirano has extensive experience and expertise as a corporate manager. Consequently, he has been appointed to supervise overall management from a position independent from that of a director with the objective of promoting even more appropriate auditing. A significant amount of time has passed since Mr. Hirano retired from his position as president of Toyota Motor Corporation, and he currently receives no benefits from that organization. In addition, after retiring he served as president of the Central Japan International Airport Co., Ltd., and we recognize that he currently has no relationship with Toyota Motor Corporation. Consequently, we judge that no danger exists of conflicts of interest with general shareholders, consider him appropriate as an auditor, and have appointed him as an independent auditor. | Board of Directors' meetings Attended 8 of 8 meetings Audit & Supervisory Board meetings Attended 8 of 8 meetings |

Amounts of Remuneration and Methods of Determining Remuneration

Directors

Remuneration for directors consists of fixed-amount salaries and executive bonuses provided that they are responsible for improving business results every fiscal year, as well as medium to long-term corporate value. Fixed-amount salaries are based on their professional ranking and the management environment. Executive bonuses are based on the business results of the KDDI Group, representing their sector and the individual's performance during the fiscal year.

To clarify management responsibilities and enhance incentives for business improvement, executive bonuses after FY2011 have been linked to the business results of the KDDI Group within 0.1% of consolidated net income in the fiscal year. This linking has been set by taking into account the responsibility of directors to sustain continuous growth and to lead the new age while swiftly reacting to environmental changes within the Group.

Audit & Supervisory Board Members

Remuneration for Audit & Supervisory Board Members is based on discussions with Audit & Supervisory Board Members and is only a flat-rate salary that is not linked to the business results of the KDDI Group.

Remuneration Advisory Committee

The Company has formed a Remuneration Advisory Committee to discuss with and provide advice to the Board of Directors in order to maintain both transparency and objectivity on the system of and the level of remuneration for executives. More than half of its members are outside directors (six people, including four outside directors, the president, and the chairman).

Remuneration for Executive Members (FY2014)

| Executive classification | Total remuneration (millions of yen) |

Total remuneration by type (millions of yen) |

Number of corresponding executives | |

|---|---|---|---|---|

| Basic remuneration |

Bonus | |||

| Directors (Excluding Outside Directors) | 536 | 387 | 148 | 11 |

| Outside Directors | 27 | 27 | - | 3 |

| Audit & Supervisory Board Members (Excluding Outside Audit & Supervisory Board Members) | 47 | 47 | - | 3 |

| Outside Audit & Supervisory Board Members | 40 | 40 | - | 3 |

Status of Measures and Policies Providing Incentives for Directors

In addition to introducing a remuneration plan linked with consolidated operating performance and a system of stock acquisition rights, in September 2015 KDDI will introduce a stock compensation plan for executives. This plan targets directors, executive officers, and administrative officers (excluding directors residing overseas, outside directors, and part-time directors).

The plan has a clear link between remuneration for directors and other executives, operating performance, and the share price, and is intended to heighten their awareness of contributing to increases in operating performance and corporate value over the medium to long term. Under the plan, each fiscal year executives will be granted the right to acquire a certain number of shares depending on their rank, achievement level of operating performance, and key performance indicators. At the conclusion of the trust period, the accumulated shares will be transferred to the executives. These shares may not be acquired during an executive's tenure as director.

- Recommended Contents

-