Features

Feature 1: Strengthening the Life Design Business

Penetration of mobile phones in Japan had already exceeded 100%[1] as of March 31, 2014, and growth has been slowing since then. Further, because the MVNO market is expected to continue growing, in addition to shrinking customer flows among mobile network operators (MNOs) that have received spectrum allocations, we believe sustainable growth based on the domestic telecommunications business alone will be more difficult.

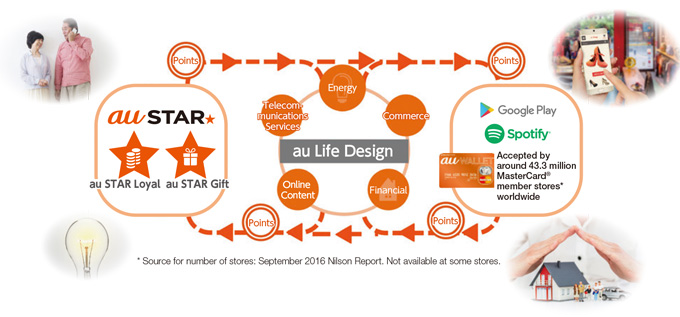

Given these market conditions, KDDI is aiming for sustainable growth by providing a comprehensive set of "au Life Design" services tailored to the life stage of each customer in addition to its traditional telecommunications services. We are also expanding the "au Economic Zone" based on our existing domestic telecommunications business customer base and settlement platforms.

In the life design business, we provide customers subscribing to telecommunications services with a variety of services relevant to everyday life, in combination with settlement methods including carrier billing ("au Simple Payment") and "au WALLET" (prepaid cards and credit cards), together with online touchpoints such as "au Smart Pass" and "au Smart Pass Premium," and offline through au shops nationwide.

Leveraging its domestic telecommunications customer base, we will provide a variety of services that enable customers to accumulate WALLET points, and by circulating those points within the "au Economic Zone," we will maximize the "au Economic Zone."

Life Design Business

In terms of mobile phones, au brand services have 25.14 subscribers (38.79 million subscriptions) [2], while MVNO services offered by KDDI subsidiaries reached 870,000 contracts [2]. In fixed-line communications, FTTH services such as "au HIKARI" reached 4.08 million subscriptions [2], while 5.29 million households [2] subscribed to CATV services. KDDI life design services will be offered to customers of these telecommunications services through our 2,500 au shops nationwide as well as other various contact points.

Membership of "au Smart Pass," which offers unlimited access to popular apps and enhanced security and safety through au smartphone replacement and support services, has reached 15.22 million members [2]. Also, membership of "Video Pass," "Uta (Music) Pass," and other services are also growing steadily.

In January 2017, KDDI launched "au Smart Pass Premium," an upgraded service of "au Smart Pass." With "au Smart Pass Premium," we are further enhancing special offers and peace of mind through services including "au Everyday," which offers daily discounts on movies and karaoke and free gifts such as french fries, "Data Recovery Support" when handsets become damaged, and "Wi-Fi Security," which protects communications when connected via Wi-Fi.

KDDI provides its own shopping services through "au WALLET Market" as well as through "Wowma!," a comprehensive shopping mall site that launched on January 30, 2017.

"Wowma!" will enable us to build touchpoints even with customers who may not be au users. We will further strengthen the service by expanding the number of shops and products through strategic spending of ¥10 billion through the year ending March 31, 2018.

In conjunction with the liberalization of the electricity retail market in April 2016, KDDI launched the "au Denki" service, providing electric power supplied by regional power companies. A wide range of customers with various household compositions and electricity usage characteristics have applied for the service, and in April 2017, KDDI also began providing "Kanden Gas for au," entering the city gas retail market through an operating partnership with the Kansai Electric Power Company, Incorporated. At the same time, customer retention has also grown with a rise in the percentage of customers paying for these services with the "au WALLET" credit card as a set.

KDDI also handles au-branded financial products as an agent for life insurance, non-life insurance and mortgage products offered by our Group companies through "au Insurance" and "au Mortgage." Because financial services have deep relevance to customers' life events, as well as a strong affinity with mobile phone services, KDDI aims to use them to build long-term relationships with customers.

On July 31, 2017, KDDI launched "au HOME," an IoT service for individuals that uses smartphones, sensors, and other devices to allow users to check on the status of their homes when they are outside and gives them remote control over home appliances. Going forward, we will expand these services further mainly through speech recognition services and provide enhanced customer experience value in a collaboration with Google Inc.

Settlement Platform Supporting the Life Design Business

![Number of valid cards issued [2] : Prepaid cards 18.6 million Credit cards 2.2 million au Carrier Billing](http://media3.kddi.com/extlib/english/corporate/ir/ir-library/annual-report/2017-selected/feature1/index/img_07.jpg)

Circulation of WALLET Points

KDDI rewards WALLET points to its customers for monthly telecommunications service usage. "au STAR Loyal," a benefit for long-term use of au, and life design services such as "au Denki," a framework to accumulate points in a variety of situations easily. Previously, those points had limited applications. Today, they can be used for commerce services such as "Wowma!", to pay for purchases with "au WALLET" prepaid cards, and just like cash at real stores, all of which contribute to the expansion of the "au Economic Zone." Customers can accumulate even more points when they use their points or pay by "au WALLET" credit card. This makes a positive cycle of "use" and "accumulation" of points and also generates revenue for KDDI in the form of settlement fees from each of those transactions. As this circulation model increasingly grows, ecosystem functionality also expands leading to maximization of the "au Economic Zone" as well as its contribution to the Company's performance.

Contributions to Performance

In addition to expanding and enhancing the services of the life design business, the WALLET point circulation model contributed to solid growth in "au Economic Zone" gross merchandise value from ¥730.0 billion in the fiscal year ended March 31, 2016 to ¥1.28 trillion in the fiscal year ended March 31, 2017. We aim to exceed ¥1.7 trillion in the fiscal year ending March 31, 2018 and ¥2.0 trillion in the fiscal year ending March 31, 2019, the final fiscal year of our current medium-term targets.

Along with this growth in gross merchandise value, the contribution of the "au Economic Zone" to the performance of KDDI has also steadily increased. We will continue working toward further expansion of the "au Economic Zone."

![Gross Merchandise Value of the "au Economic Zone" [3]](http://media3.kddi.com/extlib/english/corporate/ir/ir-library/annual-report/2017-selected/feature1/index/img_09.gif)

- Other IR Information

Investor Relations

E-mail Alerts

- KDDI IR Official Twitter

- Recommended Contents

-