- KDDI HOME

Corporate Information

Corporate Information  Sustainability

Sustainability  Governance

Governance

Governance

KDDI's Approach and Guidelines on Corporate Governance

As a telecommunications operator that provides social infrastructure, the Company has the important social mission of providing stable telecommunications services on an ongoing basis, 24 hours a day and 365 days a year, regardless of conditions. Furthermore, our telecommunications business derives from utilizing radio waves―an important asset shared by all citizens. Accordingly, we recognize that we have the social responsibility to address the issues society faces and seek to resolve them through telecommunications business. Attaining sustainable growth and increased corporate value over the medium to long term is essential to achieving this social mission and social responsibility. Furthermore, we strive to engage in dialogue with all our stakeholders (including customers, shareholders, business partners, employees, and local communities), and work in cooperation to proactively address societal issues. In this manner, we aim to contribute to the development of a safe, secure, and truly connected society. We recognize reinforcing corporate governance as important to achieving sustainable growth and increasing corporate value over the medium to long term. Accordingly, we are in accordance with the tenets of the "Corporate Governance Code" defined by the financial instruments exchanges.

While maintaining transparency and fairness, we endeavor to enhance our structures for ensuring timely and decisive decision-making. In addition to our corporate credo and the KDDI Group Mission Statement, we have formulated the "KDDI Group Philosophy," which defines perspectives, values, and a code of conduct that executives and employees should share. We conduct activities to promote awareness of this philosophy throughout the Company.

By proactively adhering to Japan's Corporate Governance Code and practicing the KDDI Group Philosophy as two basic pillars of corporate management, we will endeavor to enhance corporate governance throughout the KDDI Group, including its subsidiaries, to achieve sustainable growth and increase corporate value over the medium to long term.

Reasons for Non-Compliance with the Principles of Japan's Corporate Governance Code

To achieve sustainable growth and increase corporate value over the medium to long term, we are continuously working to strengthen our corporate governance, and we comply with all corporate governance codes.

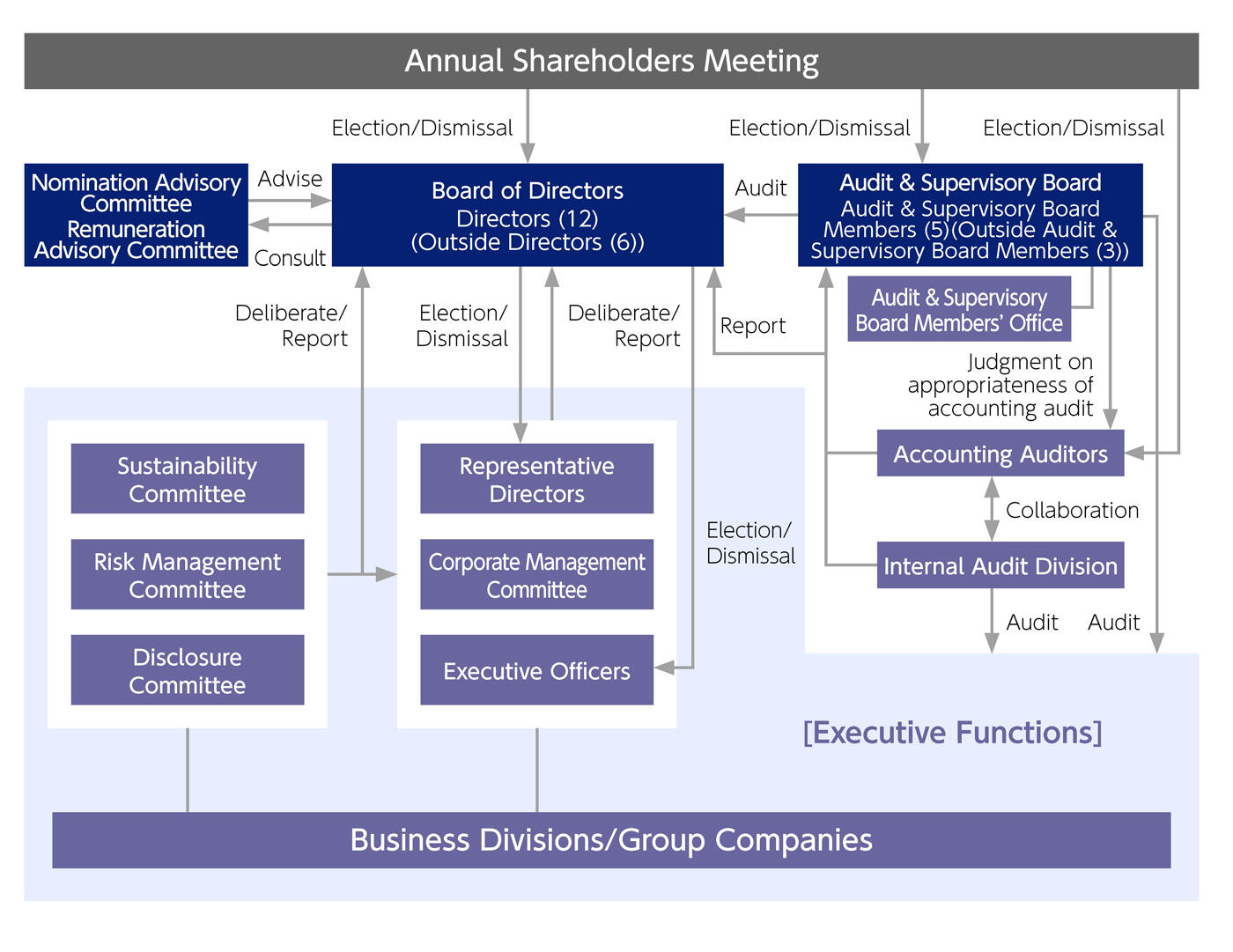

Corporate Governance Promotion Framework

We believe strengthening corporate governance to be one of the most vital issues in enhancing corporate value, and we are working to improve management efficiency and transparency.

KDDI is currently a company with Audit & Supervisory Board, and in order to properly manage business execution, we have introduced an executive officer system to assign authority, clarify responsibilities and ensure effective and efficient business operations. We are also working to establish a framework for internal decision making to ensure timely management decisions. The number of directors is 12 (10 male and 2 female), including 6 outside directors, 4 of whom are independent directors, meeting the criteria for the ratio of independent outside directors (1/3 or more) required of companies listed on the Tokyo Stock Exchange Prime Market under the Corporate Governance Code. The Audit & Supervisory Board consist of 5 members (all male), including 3 Outside Audit & Supervisory Board members, who are designated as independent auditors. Regarding independent directors, the Company has a total of 7 independent directors and auditors, ensuring a high degree of independence.

For the outside directors/auditors, we provide opportunities for each area's supervisor to explain industry trends, together with our organization, businesses, technologies, and future strategies in a manner that deepens their understanding of the Company and stimulates discussion at Board of Directors meetings. Additionally, the Company provides individual training sessions when requested by outside directors/auditors, ensuring there are sufficient opportunities to receive training and improve knowledge where necessary. Plus, we also provide access to in-house exhibitions of R&D achievements, alongside site visits to telecommunications facilities, monitoring and maintenance centers, and other key faculties.

We report twice a year on corporate ethics, risk management activities, and internal audit processes. Moreover, in order for outside directors to strengthen their ability to gather information, they are invited to attend meetings of the Audit & Supervisory Board when the auditing firm reports the results of the second-quarter review and the year-end audit, and liaison meetings with Audit & Supervisory Board members are held twice a year. In addition to the above, to strengthen information exchange and sharing between outside directors, we hold liaison meetings exclusively for outside directors and liaison meetings for outside directors and part-time Outside Audit & Supervisory Board members.

We aim to raise the effectiveness of the Board of Directors' supervision of management and invigorate discussions of management strategies at board meetings by providing a deeper understanding of our business through these initiatives.

Corporate Governance Framework

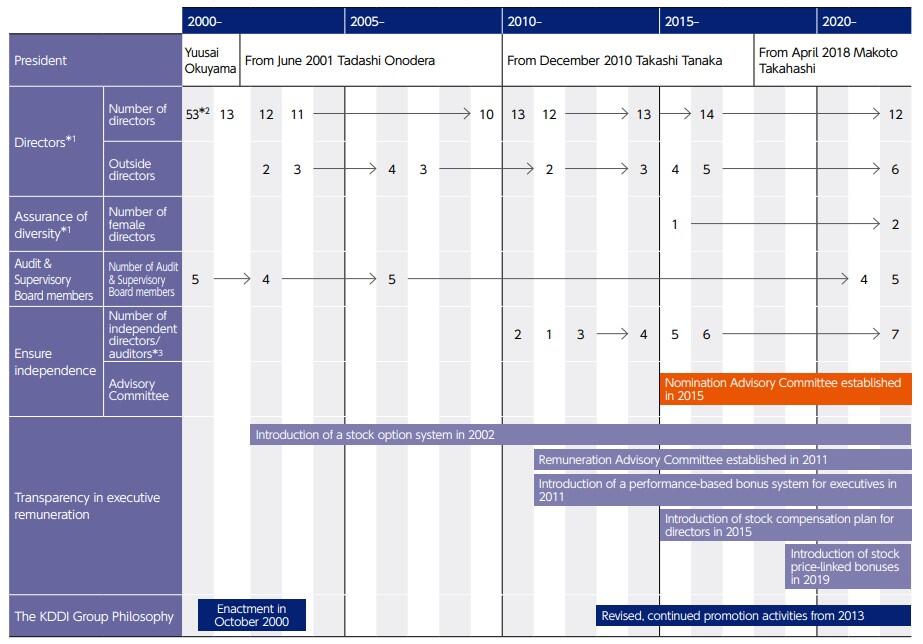

Changes in the Corporate Governance Framework

- *1Number of people at the conclusion of each Annual General Meeting of Shareholders

- *2Number of people at the launch of KDDI in October 2000

- *3Independent directors/auditors pursuant to Rule 436-2 of the Securities Listing Regulations of Tokyo Stock Exchange, Inc.

Criteria for Independence of Outside Directors/Auditors

In addition to the requirements in the Companies Act and the standards provided by financial instruments exchanges we have formulated our own standards for judging the independence of outside directors/auditors. Specifically, we consider those belonging to business partners that account for 1% or more of the company's consolidated operating revenue or orders placed not independent.

Directors and Board of Directors

At the Board of Directors, to balance the fairness of management decisions and the steady promotion of growth strategies, internal directors who are responsible for each area fulfill their accountability in the decision-making of important matters and management plans stipulated in laws and regulations. The directors are making decisions that ensure effectiveness and fairness through active discussions that utilize the insights of external officers with various backgrounds.

In addition, the Board of Directors regularly reports on the progress and achievement of the Mid-Term Management Strategy and annual plan that underpin company operations. Deliberations are conducted with a focus on strategies to achieve key goals and measures, as well as to addressing management issues arising from business environment changes and other factors, with the aim of achieving sustainable growth and increasing corporate value over the medium to long term.

Specific matters discussed by the Board of Directors

| 1 | Medium- to long- term strategy | The Mid-Term Management Strategy, the business environment analysis, etc. |

|---|---|---|

| 2 | Company-wide plan and progress report | Various company-wide plans for each fiscal year, quarterly financial results, business execution reports, etc. |

| 3 | Individual business division cases | Investments, asset acquisitions, alliances with other companies, etc. |

| 4 | Requests by Laws, Regulations, and Articles of Incorporation | Capital policy (dividends, treasury stock-related matters), executive appointments and remuneration, convocation of General Meeting of Shareholders, etc. |

Board of Directors Meetings (Fiscal 2022)

| Number of meetings held |

Internal directors' attendance rate |

Outside directors' attendance rate |

Internal auditor's attendance rate |

Outside Audit & Supervisory Board members' attendance rate |

|---|---|---|---|---|

| 11 | 100% | 100% | 100% | 100% |

Evaluation of the Board of Directors' Effectiveness

Purpose of Conducting

We conduct a self-evaluation of the Board of Directors regularly every year in order to correctly understand its situation and continuously improve its operation.

Evaluation Process

We assess the effectiveness of the Board of Directors based on an evaluation by all the directors and Audit & Supervisory Board members themselves. The evaluation questionnaire combines a four-grade rating scale and free writing so that the effectiveness of the board's initiatives are assessed and matters to be improved are identified from two perspectives: quantitative and qualitative. The evaluation is conducted annually and covers the most recent one-year period. The results of the evaluation are reported back to the Board of Directors and future measures are discussed. The main evaluation items are as follows.

Main Evaluation Items

| 1 | Operation of the Board of Directors | Composition of members, documents and explanations, provision of information, etc. |

|---|---|---|

| 2 | Supervision of Executives | Conflict of interest, risk management, management of subsidiaries, etc. |

| 3 | Medium- to long-term discussions | Participation in Mid-Term Management Strategy, monitoring plan execution, etc. |

Evaluation Results

Summary

The evaluation confirmed that KDDI's Board of Directors is operating properly and functioning effectively. The following two points received particular praise:

- The management of Board of Directors meetings are effectively utilizing the knowledge of outside directors/auditors from various backgrounds

Discussions at Board of Directors meetings are active, and the Board of Directors operates in an open atmosphere that allows outside directors/auditors to actively speak out. Additionally, the executive side provides appropriate explanations for and responses to the comments and suggestions that leverage the insights of various outside directors/auditors. - Initiatives to enhance discussions at Board of Directors meetings

The material contents necessary for deliberation are presented concisely, with all points at issue clarified. In addition, information and opinions on important issues, such as M&A, are provided and exchanged in advance via off-site meetings, etc., helping the Board of Directors to improve the effectiveness of management oversight.

Moving Forward

- Further advancement of our group governance

Based on previous issues, we have been working on the establishment of a new support division and a monitoring system. By regularly reporting and sharing progress and issues, we will further strengthen group governance at the Board of Director's supervision meetings. - Enhancement of discussions on important themes from the perspective of improving corporate value over the medium to long term

We've received proposals from each director and Audit & Supervisory Board member on various themes that should be discussed, such as medium- to long-term growth strategies and important non-financial agendas. Moving forward, these themes will be taken up regularly at the Board of Directors meetings and off-site meetings. Furthermore, we will work to further improve the Board of Director's effectiveness by holding extensive discussions with outside directors/auditors.

Audit & Supervisory Board and Audit & Supervisory Board members

The KDDI Audit & Supervisory Board is composed of 5 members, including 3 outside members. Audit & Supervisory Board members conduct audits in accordance with the audit policy, execution plans for auditing, audit methods and work assignments determined by the Audit & Supervisory Board. All 3 Outside Audit & Supervisory Board members are independent auditors.

Full-Time Audit & Supervisory Board members attend meetings of the Board of Directors, as well as the Corporate Management Committee and other major meetings (Management Strategy Meeting, Monthly Profitability Review Meeting, KDDI Group Business Ethics Committee, etc.) to perform their audit duties, and express their opinions, as necessary. In addition, in order to ensure sufficient communication with Representative Directors and to deepen mutual recognition and trust, they exchange opinions with Representative Directors twice a year on important audit issues, improvement of the auditing environment for Audit & Supervisory Board members, audit results, and requests related to audits.

Part-time Outside Audit & Supervisory Board members receive reports on and discuss the auditing methods and results of the full-time Audit & Supervisory Board members at the Audit & Supervisory Board meetings, receive explanations of management policies and growth strategies at Board of Directors meetings, and express their opinions as appropriate from their standpoint as independent auditors. In addition, to promote communication with Representative Directors, roundtable meetings are held twice a year to exchange opinions.

In addition, Audit & Supervisory Board members obtain a written explanation of the audit plan, which includes the audit policy, audit plan, and audit system of the accounting auditors, and they also receive explanations and exchange opinions on the content of the explanation. Furthermore, the Company receives quarterly reports from the accounting auditors on the methods and results of audits (including quarterly reviews) and holds discussions with them. In addition, the Company communicates with the accounting auditors as necessary and exchanges opinions to contribute to the formation of mutual audit opinions.

The Audit & Supervisory Board Member's Office has been established as a division to assist the Audit & Supervisory Board members in their duties. The Audit & Supervisory Board Member's Office has dedicated employees, and each Audit & Supervisory Board member has the right to direct and order these employees, with the prior consent of the Audit & Supervisory Board or a full-time Audit & Supervisory Board member as determined by the Audit & Supervisory Board.

Audit & Supervisory Board Meetings (Fiscal 2022)

| Number of meetings held | Full-time Audit & Supervisory Board members' attendance rate |

Part-time Outside Audit & Supervisory Board members' attendance rate |

|---|---|---|

| 12 | 100% | 100% |

Internal Audits

We have established the Internal Audit Department under the Internal Audit Division to clarify the roles and responsibilities within the "Three-Lines Model" across business, administrative, and audit divisions to improve the model's effectiveness and to ensure the independence of the three-line function. The Department conducts internal audits of KDDI Group operations on the key risks identified through risk management activities.

The results of internal audits are reported to the Company President, Representative Director and Audit & Supervisory Board members together with requests and recommendations concerning improvements and corrective measures to address highlighted issues, and the status and results of internal audits are also reported to the Board of Directors every quarter.

In FISCAL 2022, a total of 37 audits were carried out to monitor the progress of corrective/improvement measures and to prevent risks from materializing.

Nomination Advisory Committee and Remuneration Advisory Committee

To ensure the transparency and fairness of systems and standards for nomination of directors and Audit & Supervisory Board members and their executive remuneration, we have established the Nomination Advisory Committee and the Remuneration Advisory Committee, which deliberate and provide advice to the Board of Directors based on discussions thereof. The chair, vice-chair and more than half of the members of these committees are independent outside directors.

Meetings Held Fiscal 2022

The Nomination Advisory Committee met four times, and all members attended each time, where the committee provided advice on proposals submitted to the Board of Directors concerning the appointment of directors and executive officers, etc. The Remuneration Advisory Committee met once, and all members attended. The committee discussed the advice concerning proposals submitted to the Board of Directors for the determination of performance-linked remunerations and stock price-linked remunerations.

Internal Committees

- KDDI Group Business Ethics Committee: deliberates and makes decisions on compliance-related items for the Group

- Disclosure Committee: deliberates on financial results information to be disclosed at fiscal period-ends

- Sustainability Committee: This committee deliberates on sustainability-related matters such as solving social issues (SDGs), social contribution, and the environment through business.

- Information Security Committee: ensures overall information security regarding information assets

We collaborate with our group companies to manage their governance through various systems and frameworks in order to enforce the governance of the whole KDDI Group.

Approach to Composition of Board of Directors

KDDI appoints people who meet the following criteria in consideration of gender, age, nationality, race or ethnicity to ensure a diversity of opinions and highly specialized knowledge within the Board of Directors as a whole when making decisions including important management matters and implementing oversight as required by law.

Policies and Procedure for Nomination of Director and Audit & Supervisory Board Member Candidates

Appointment and Selection Standards

- For both types of candidates: Have the character suitable for being a Board member, have high ethical standards and not be self-serving

- Director candidates: Meet one or more of the following criteria:

- Have specialized knowledge and experience in each business field

- Have specialized knowledge or management knowledge suitable for a supervisor

- Have a high degree of independence

- Audit & Supervisory Board member candidates: Have a wealth of experience and broad knowledge that will enable more appropriate audits and oversight of overall management from a position that is independent from directors

Nomination and Election Procedures for Directors

- (1)Select candidates based on the above criteria

- (2)Deliberate them at a Nomination Advisory Committee

- (3)Approve them at a Board of Directors Meeting

- (4)Elect them at the General Meeting of Shareholder

Nomination and Election Procedures for Audit & Supervisory Board Members

- (1)Select candidates based on the left criteria

- (2)Deliberate them at a Nomination Advisory Committee meeting

- (3)Gain approval from the Audit & Supervisory Board

- (4)Approve them at a Board of Directors meeting

- (5)Elect them at the General Meeting of Shareholder

Consideration Criteria for Termination

- When the performance of a business that a director is responsible for or the achievements of a division a director is responsible for are exceptionally poor

- When the company is harmed by a major misstep or intentional violation of a law, regulation or the Articles of Incorporation in their execution of duties

- When the company's credibility and reputation are significantly damaged by the inappropriate seeking of personal gain through the abuse of position or authority

- When the company determines that keeping a director is not appropriate

Termination Procedures for Directors

After deliberations at the Nomination Advisory Committee meeting, the Board of Directors deliberates the matter as needed and implements necessary measures for termination

Diversity and Expertise of the Directors and Audit & Supervisory Board Members

From the perspective of achieving sustainable growth for the KDDI Group, KDDI defines six skills in areas of expertise and experience that we believe are important for our directors and Audit & Supervisory Board members. The skills possessed by each director and Audit & Supervisory Board member are as follows.

Skills Possessed by Each Director and Auditor

| Name of director/auditor | Corporate management | Sales and marketing | Global | Digital technology | Finance and accounting | Legal affairs and risk management | |

|---|---|---|---|---|---|---|---|

| Internal Directors | Takashi Tanaka | ● | ● | ● | ● | ● | ● |

| Makoto Takahashi | ● | ● | ● | ● | ● | ● | |

| Toshitake Amamiya | ● | ● | ● | ||||

| Kazuyuki Yoshimura | ● | ||||||

| Yasuaki Kuwahara | ● | ● | ● | ||||

| Hiromichi Matsuda | ● | ● | ● | ||||

| Outside Directors | Goro Yamaguchi | ● | ● | ● | ● | ||

| Keiji Yamamoto | ● | ● | ● | ||||

| Shigeki Goto | ● | ● | |||||

| Tsutomu Tannowa | ● | ● | ● | ● | |||

| Junko Okawa | ● | ● | |||||

| Kyoko Okumiya | ● | ||||||

| Audit & Supervisory Board Members | Kenichiro Takagi | ● | ● | ||||

| Noboru Edagawa | ● | ● | ● | ||||

| Yukihiro Asahina | ● | ||||||

| Toshihiko Matsumiya | ● | ● | |||||

| Jun Karube | ● | ● | ● | ● |

Principal Activities of Outside Directors and Outside Audit & Supervisory Board Members

Outside Directors

| Name | Reason for selection as an outside director of the Company (if designated as an independent director includes reason for this designation) |

Principal activities in fiscal 2022 |

|---|---|---|

| Goro Yamaguchi | Mr. Yamaguchi has a wealth of corporate management experience and excellent knowledge cultivated as the President and representative director of one of the world's leading electronic component and equipment manufacturers. On the Board of Directors, he expressed broad opinions related to business administration and operations from a medium- to long-term perspective, and has thus contributed to improving the corporate value of the Company. He has again been appointed as an outside director because the Company expects him to contribute to enhancing the supervising function of business execution based on his management experience of the other company and provide advice from a wide range of management perspectives. |

Board of Directors (Attended 11 of 11 meetings) |

| Keiji Yamamoto | Mr. Yamamoto has excellent knowledge cultivated in IT development and electronics engineering divisions and a wealth of corporate management experience as a management at one of the world's leading automobile manufacturers. On the Board of Directors, he expressed broad opinions on promoting KDDI's 5G/IoT strategy, etc., from a medium- to long-term perspective, and has thus contributed to improving KDDI's corporate value. He has again been appointed as an outside director because the Company expects him to contribute to enhancing the supervising function of business execution and provide advice in the telecommunications field from technical perspectives. | Board of Directors (Attended 11 of 11 meetings) |

| Shigeki Goto (Independent director) |

Mr. Goto has a superior knowledge in information processing, telecommunications and network engineering, which is directly relevant to KDDI's business, as well as a deep understanding of cyber security that is valuable for the operation of our business. On the Board of Directors, although he has no direct experience in company management, he expressed technical opinions related to operational policy as an information communications operator providing social infrastructure, from a medium- to long-term perspective independent of the KDDI's management team, and has thus contributed to improving KDDI's corporate value. He has again been appointed as an outside director because the Company expects him to contribute to enhancing the supervising function of business execution and provide advice in the telecommunications field from technical perspectives. | Board of Directors (Attended 11 of 11 meetings) |

| Tsutomu Tannowa (Independent director) |

Mr. Tannowa has a wealth of corporate management experience cultivated as the President and Representative Director of a major chemical manufacturer, while also offering excellent insight from a global perspective. On the Board of Directors, he contributes to enhancing KDDI's corporate value by providing advice from a medium- to long-term perspective, independent of the KDDI's management team based on his management experience at the other company and by helping to strengthen the supervisory function of business execution. He has again been appointed as an outside director because the Company expects him to contribute to strengthening the supervisory function of business execution and provide advice from a broad managerial perspective. | Board of Directors (Attended 9 of 9 meetings) |

| Junko Okawa (Independent director) |

Ms. Okawa has a wealth of corporate management experience, in addition to excellent insight cultivated from her work experience at a major airline company, especially in practical aspects such as customer service, corporate revitalization, and diversity promotion. On the Board of Directors, she contributes to enhancing KDDI's corporate value by providing advice from a medium- to long-term perspective, independent of our management team based on her management experience at other companies and by helping to strengthen the supervisory function of business execution. She has again been appointed as an outside director because the Company expects her to contribute to strengthening the supervisory function of business execution and provide advice from a broad managerial perspective. | Board of Directors (Attended 9 of 9 meetings) |

| Kyoko Okumiya (Independent director) |

Ms. Okumiya has a wealth of experience and excellent expertise developed as a partner of a law firm and a member of various committees. Although Ms. Okumiya has no direct experience in corporate management, she has been appointed as an outside director because we believe that she can contribute to the enhancement of our corporate value by providing expert opinions on legal risk management from a medium- to long-term perspective, independent of our management team. | ― |

- *Attendance of Mr. Tsutomu Tannowa and Ms. Junko Okawa is after their appointment as directors at the 38th Annual Shareholders Meeting held on June 22, 2022.

- *Ms. Kyoko Okumiya is a new director who was appointed at the 39th Annual Shareholders Meeting held on June 21, 2023.

Outside Audit & Supervisory Board Members

| Name | Reason for selection as an outside auditor of the Company (if designated as an independent auditor includes reason for this designation) |

Principal activities in fiscal 2022 |

|---|---|---|

| Yukihiro Asahina (Independent auditor) |

Mr. Asahina has cultivated abundant experience and knowledge gained from many years of practical experience in the public sphere and involvement in the execution of business at various organizations. From the perspective of leveraging this knowledge and experience to monitor general management and to engage in appropriate audit activities, he has been appointed as an Audit & Supervisory Board member. | Board of Directors (Attended 11 of 11 meetings) Audit & Supervisory Board (Attended 12 of 12 meetings) |

| Toshihiko Matsumiya (Independent auditor) |

Mr. Matsumiya has an abundance of experience and knowledge as a Certified Public Accountant, as an employee of an auditing company, as the representative of an accountancy firm, as an auditor for other companies as well as experience and insight cultivated through the execution of duties at various organizations. From the perspective of leveraging this primarily accounting-related knowledge and experience to monitor general management and to engage in appropriate audit activities, he has been appointed as an Audit & Supervisory Board member. | Board of Directors (Attended 11 of 11 meetings) Audit & Supervisory Board (Attended 12 of 12 meetings) |

| Jun Karube (Independent auditor) |

Mr. Karube has cultivated abundant experience and knowledge as a representative director of a listed company. From the perspective of leveraging this knowledge and experience to monitor general management and to engage in appropriate audit activities, he has been appointed as an Audit & Supervisory Board member. | Board of Directors (Attended 11 of 11 meetings) Audit & Supervisory Board (Attended 12 of 12 meetings) |

Remuneration for Directors and Audit & Supervisory Board Members

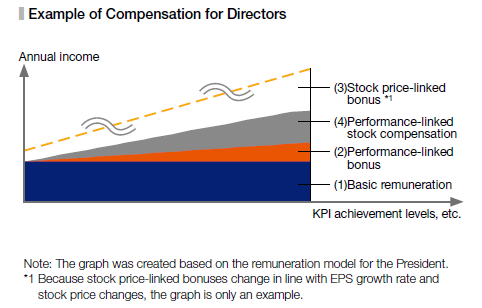

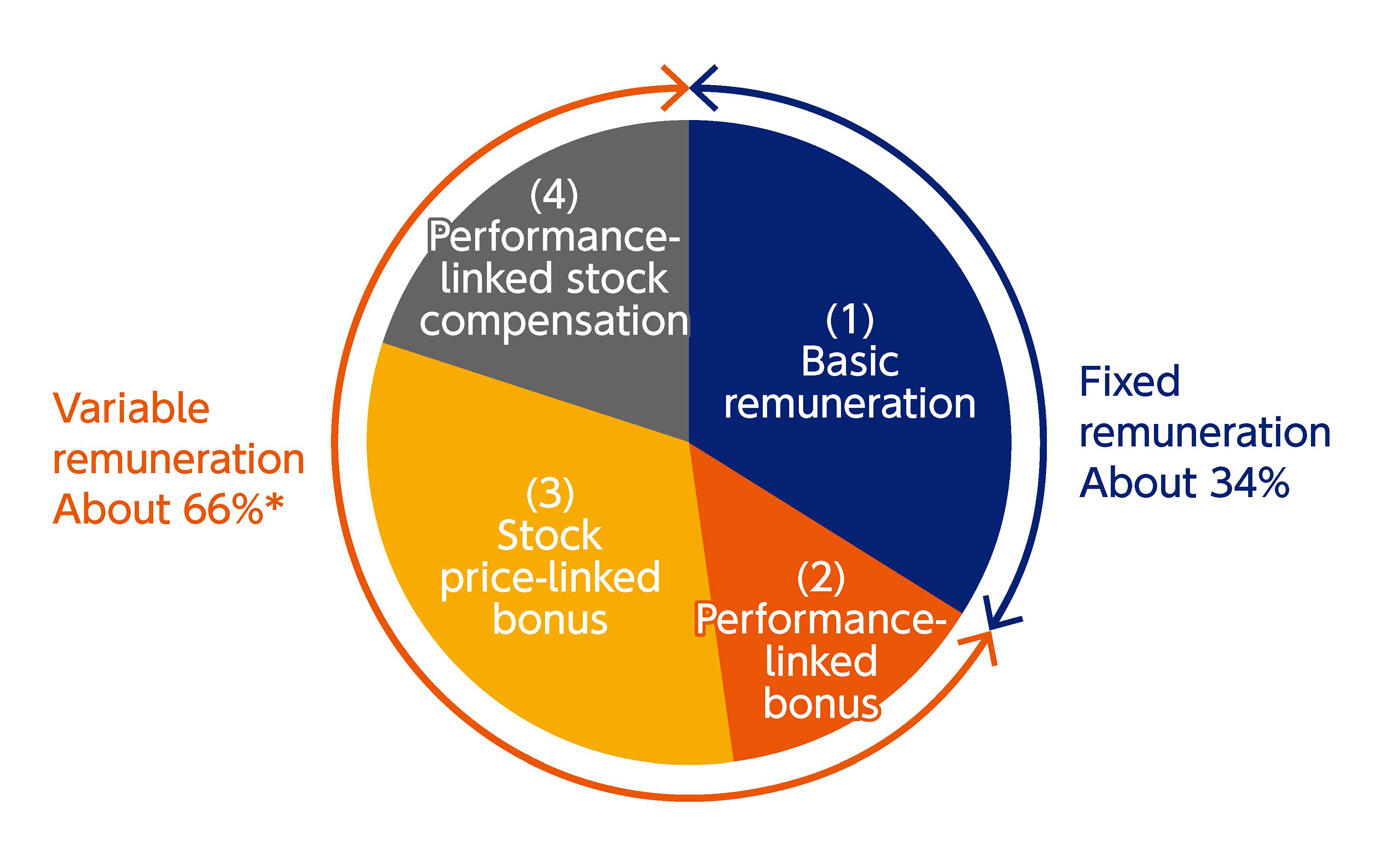

Remunerations for Directors

- The compensation of directors engaged in business execution is based on the KDDI Group's business performance for each fiscal year, progress toward the goals of the Mid-Term Management Strategy, and a compensation system linked to shareholder value in order to increase the willingness to contribute to the improvement of corporate value over the medium to long term.

- Outside directors who perform management supervising functions without involvement in the execution of businesses receive only fixed amount remuneration that does not vary with the Company's business performance.

- The Company has established the Remuneration Advisory Committee to ensure transparency and objectivity in the process of determining the system and levels of executive remuneration, along with the remuneration amounts based on these. This committee's chair, vice-chair, and more than half of the committee members are independent outside directors.

- The decision of the amounts of basic remuneration, performance-linked bonus, performance-linked stock compensation, and stock price-linked bonus are not delegated to the representative director, but the amounts are decided by resolution of the Board of Directors based on the advice of this committee.

- KDDI's executive remuneration levels are decided through comparison with sector peer companies, or with other companies of the same scale, in Japan, and take into account factors that include KDDI's management status. The appropriateness of the remuneration levels is also validated by the Remuneration Advisory Committee every year, with reference to objective survey data from an external specialized organization.

- For those who have made serious violations of the duties of directors, contrary to the delegation contract between KDDI and the directors, we may suspend the payment of performance-linked remuneration or demand the return of such remuneration.

Policy on the Content of Director Remuneration

(1) Basic remuneration

This is monetary remuneration for which a fixed amount for each position is paid on a monthly basis.

(2) Performance-linked bonus

The amount of payment for each individual is calculated by the following formula, and money is paid in the first June after the end of each fiscal year.

Performance-linked bonus: Basic amount by position multiplied by the Company's operating performance and KPI achievement rate.

(3) Stock price-linked bonus

The amount of payment for each individual is calculated by the following formula, and money is paid in the first June after the end of each fiscal year.

Stock price-linked bonus: Basic amount by position multiplied by coefficient [1].

- [1]Coefficient: (EPS growth rate x 50%) + (stock price fluctuation rate x 50%)

A) EPS growth rate: EPS at the end of current fiscal year divided by EPS at the end of previous fiscal year

B) Stock price fluctuation rate (TOPIX growth rate): (KDDI's stock price at the end of current fiscal year / KDDI's stock price at the end of previous fiscal year) divided by (TOPIX at the end of current fiscal year / TOPIX at the end of previous fiscal year)

(4) Performance-linked stock compensation

For performance-linked stock compensation, points for each individual are calculated by the following formula. Points will be awarded in the first June after the end of each fiscal year, and when the director retires, KDDI's shares will be delivered according to the cumulative number of points.

Performance-linked stock compensation: Basic points by position multiplied by the Company's operating performance and KPI achievement rate.

Reasons for selecting each evaluation metric and results are as follows:

The Company's operating performance

Reasons for selection: A basic numerical value clearly showing a company's business performance.

KPI achievement rate

Reasons for selection: KPI achievement rate is to measure the achievement rate of each business strategy under the Mid-Term Management Strategy, and therefore linked to the KDDI business growth and performance improvement.

Result: ESG-related items are also set as indicators along with indicators in each business strategy. Since FY23.3, we have increased the percentage of ESG-related items to approximately 30% of the total KPI.

EPS growth rate

Reasons for selection: To provide a strong incentive to achieve the target of the Mid-Term Management Strategy by using an indicator set as a target under the plan.

Result: 1.03

Stock price fluctuation rate

Reasons for selection: To enhance a correlation between remunerations for executives and the shareholders value by using an indicator that is directly linked with an increase/decrease in shareholders value.

Result: 0.99

Remuneration for Audit & Supervisory Board Members

Remuneration for Audit & Supervisory Board members is decided by the consensus of the members of Audit & Supervisory Board. These members receive flat-rate remuneration that is not affected by fluctuations in the company's operating performance.

Remuneration for Directors and Audit & Supervisory Board Members

Outside Director/Audit & Supervisory Board member Support System

To ensure active discussions in the Board of Directors meetings, we inform outside directors and part-time outside Audit & Supervisory Board members at least 3 days in advance of the dates and agenda items and provide agenda materials for upcoming meetings to help them gain a deeper understanding of the agenda in advance. In addition, we make the deliberations more substantial by accepting questions beforehand and preparing more extensive explanations for the meetings based on the questions.

We established the Audit & Supervisory Board Member's Office, which supports Audit & Supervisory Board members, including part-time outside members.

Policies on Parent and Subsidiary Listings

One of KDDI's subsidiaries, Okinawa Cellular Telephone Company (hereafter "Okinawa Cellular"), is listed on the Tokyo Stock Exchange Standard Market.

Being committed to "growth as a group," KDDI aims to maximize mutual synergies and expand and strengthen new growth foundations for the entire group by maximizing the use of our assets and supporting the growth of group companies.

Okinawa Cellular was established with the cooperation of several prominent local companies, making it a community-based company that contributes strongly to the local community.

Based on this background, we believe that there are the following advantages to having Okinawa Cellular as a publicly traded company, and we believe that it continues to be significant to have Okinawa Cellular as a listed subsidiary.

1. Returns to investors

By implementing shareholder returns measures as a listed company, Okinawa Cellular will be able to return profits to its investors, including local companies that cooperated in the company's establishment and investors who have supported the company since its listing.

Okinawa Cellular's shareholder returns policy should be determined in consideration of the interests of all shareholders, taking into account the balance between medium- and long-term business growth and shareholder returns, and its implementation will be determined at the company's discretion as an independent listed company.

2. Contributing to employment in Okinawa prefecture and securing talented human resources

Currently, many people from Okinawa prefecture have joined Okinawa Cellular and are playing an active role in the company. Given the geographical characteristics of Okinawa Cellular, we believe that the fact that its business area is limited to Okinawa prefecture meets the needs of people from Okinawa who wish to work locally, and the fact that Okinawa Cellular is a publicly listed company also helps us recruit talented personnel.

3. Promote the use of Okinawa Cellular's services and increase subscriptions by earning the trust of Okinawa residents

In addition to KDDI's similar services, Okinawa Cellular also offers unique services based on local conditions. As a community-based listed company, we believe that we have earned the trust of people in Okinawa by operating our business in line with the expectations of the local community, and this has led to the promotion of Okinawa Cellular's service use and increased subscriptions.

For transactions that may cause conflicts of interest, Okinawa Cellular determines whether to implement the transaction after multifaceted discussions by independent outside directors and independent outside auditors. Okinawa Cellular has also established a voluntary committee led by an independent outside director as an Advisory Committee to the Board of Directors to discuss director nominations and compensation, and decisions regarding management nominations and compensation are made after discussions by Okinawa Cellular's independent directors/auditors to ensure transparency. To appropriately control conflicts of interest, directors who concurrently serve on the Boards of KDDI and Okinawa Cellular do not participate in any resolutions or deliberations on matters related to either company, thereby ensuring their independence.

Through these efforts, we will ensure management transparency from the perspective of protecting minority shareholders, and at the same time meet the expectations of our shareholders by increasing corporate value and shareholder returns.

KDDI will continue to respect independence and autonomy while mutually cooperating with Okinawa Cellular in business operations and development as a group.

Policy on Strategic Shareholdings

KDDI believes that participating in tie-ups with a variety of companies is essential to providing our customers with increasingly diverse and advanced services.

KDDI possesses strategic shareholdings if such possession will contribute to the sustainable growth of KDDI's business and the medium- to long-term increase of corporate value.

Every business year, the Board of Directors reviews all the pros and cons of continuing the possession and the number of shares to be held of each individual strategic holding by judging its significance and economic rationale. When a strategic shareholding is found to have only tenuous significance, KDDI will sell or reduce as promptly as possible.

KDDI calculates the ratio of the contribution by the issuing company to the KDDI's profits within the most recent fiscal year. The economic rationale is verified by comparing the ratio with the valuation of each strategic shareholding at the end of the most recent fiscal year, and confirming whether the ratio satisfies the capital cost standard established by KDDI.

Communication with Shareholders

We consider our shareholders and investors to be especially important stakeholders who fully understand and strongly support our business sustainability. Accordingly, we put the highest emphasis on building trust-based relationships with them in our management and strive to practice value-oriented corporate management, active information disclosure and enhanced communication.

As part of our ongoing effort to improve communication, we hold quarterly presentation sessions, where the management team presents KDDI's financial results directly. In addition, we organize private meetings and small-scale meetings with investors from both Japan and abroad and attend various conferences hosted by securities firms.

Vitalizing the General Meeting of Shareholder and Facilitating the Exercise of Voting Rights

| Measures | Content |

|---|---|

| Early disclosure of the General Meeting of Shareholder Notice | We disclose and send a notice both electronically (by posting on our website) and by mail around one week before the stipulated deadline. |

| Scheduling to avoid days when many other companies hold the General Meeting of Shareholder | We schedule the General Meeting of Shareholders to avoid days when many other companies hold their shareholders' meetings. |

| Electronic voting system | Shareholders can exercise their voting rights via an online voting site. We have also introduced a system where shareholders can log in to the online voting site using a QR code in an effort to make things more convenient. |

| Participating in an electronic voting platform | We have joined the electronic voting platform. |

| English version of convocation notice | We publish a full English translation of the convocation notice on our website, online electronic voting site and voting platform. |

Others

|

|

Adoption of Takeover Defense Measures

Adoption of Takeover Defense Measures Not adopted

- Sustainability

-

- Environment

- Society

- Governance

- Mid-Term Sustainability Targets

- President's Message

- KDDI's Commitment to Sustainability

- KDDI's SDGs

- Integrated Sustainability and Financial Report

- ESG data

- Compliance

- Community Cooperation (in Japanese only)

- Social Contribution Activities

- Sustainability News (in Japanese only)

- External Recognition/Initiatives

- Recommended Contents

-