- KDDI HOME

Corporate Information

Corporate Information  Sustainability

Sustainability  Compliance

Compliance

Compliance

Compliance Policy

In addition to complying with laws and regulations, we recognize that in order to fulfill our social responsibilities through our business activities, raising compliance awareness throughout the Group is a fundamental issue of corporate management. As a global corporate group, we continue to further enforce our group-wide compliance framework.

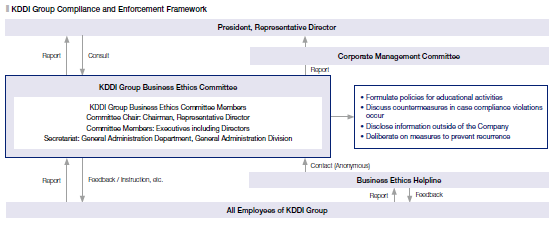

KDDI Group Compliance and Enforcement Framework

We created the KDDI Code of Business Conduct to support ethical behavior and ensure that every employee cultivates a compliance mindset. To ensure that the Code is shared and practiced, it is published on the intranet and a web link to the Code is put in business mobile devices lent to employees, enabling employees to check it whenever they are unsure what action to take. Also, we established the KDDI Group Business Ethics Committee as a decision making body for KDDI Group's compliance related matters.

The committee is chaired by the Chairman, Representative Director, and members include directors and additional nominees appointed by the chair as required. The committee holds a meeting once every half-year, and in addition to assessing the conditions of Group companies, it builds and supports enhancement of compliance frameworks. The committee is also responsible for helpline issues, corruption prevention and compliance issues such as breaches of competition laws.

Under the KDDI Group Business Ethics Committee, the committee formulates policies on raising awareness, discusses countermeasures in case compliance violations occur and is responsible for disclosure of such information as well as the prevention of recurrence. In addition, the reports on their activities are made available to all employees via the intranet.

Anti-Corruption Measures

Basic Approach to Anti-corruption

To prevent corrupt practices, the KDDI Code of Business Conduct defines the principles of promoting fair business activities and the conscientious performance of duties and prohibits activities such as bribing politicians and public officials, along with other similar types of corruption.

Specifically, this includes any business entertainment, gift and invitation given to a public official in the course of business with governmental agencies that is prohibited under the National Public Service Act and other applicable laws and regulations.

KDDI has established that, when dealing with overseas governments and companies, employees will not provide any business entertainment, gift or invitation as stipulated in the UN Convention against Corruption as well as the laws and regulations of the relevant countries against foreign corrupt practices and unfair competition.

In addition to the above, we also stipulate the elimination of organized crime groups and prohibition of insider trading and anti-competitive behavior, and any violations will be punished in accordance with internal regulations. In order to prevent these violations, we use e-learning courses and e-mails to educate and inform all employees and raise their awareness [1]. In FY2021, there were no employees subject to disciplinary dismissal for violating the anti-corruption provisions of the KDDI Code of Business Conduct.

- [1]A shortcut icon for the "KDDI Code of Business Conduct," which includes compliance with the Telecommunications Business Law, Antitrust Law, Unfair Competition Prevention Act, and other relevant laws and regulations, is set on the business mobile devices lent to employees so that they can always check it.

Sustainable Procurement

We also urge business partners to comply with the KDDI Group Sustainable and Responsible Procurement Guidelines, which defines rules for prohibition of corruption, bribery, abuse of power and giving or receiving illicit funds.

Political Contributions

For any political donations we make, we observe the Political Funds Control Act and follow the KDDI Code of Business Conduct and the KDDI Group Sustainable and Responsible Procurement Guidelines.

In FY 2021, we made political donations totaling 6 million yen in Japan, and there were no cases of legal action against us concerning corruption or bribery.

Elimination of Organized Crime Groups (Basic Approach and Implementation Status)

Our Basic Policy for the Creation of Internal Systems takes a firm stand on countering organized crime groups.

In addition to rules defining initiatives for blocking off any relations with such groups, the KDDI Code of Business Conduct, which defines basic principles to be followed and enforced by all officers and employees, takes a firm stance against organized crime groups, rejecting any requests for illicit funds and refusing to comply with any demands.

Preventing Anti-competitive Behaviors

The KDDI Code of Business Conduct defines rules that prohibit anticompetitive behaviors, and we make efforts to ensure that all employees comply with competition laws.

In addition to competition laws, we stipulate that local laws and regulations in each country and region on labor, tax, the environment, consumer protection and data protection must be examined thoroughly to ensure full compliance.

Furthermore, under the KDDI Group Sustainable and Responsible Procurement Guidelines, we demand our business partners to not engage in any activities that inhibit fairness, transparency or freedom of competition.

We respond promptly to requests and guidance received from the Ministry of Internal Affairs and Communications and other government agencies, ensure compliance with relevant laws and regulations, and maintain proper business operations.

Business Ethics Helpline (Whistleblowing System)

We established the Business Ethics Helpline in 2006 to serve as a contact point for all employees of KDDI and KDDI Group companies who have questions or concerns about business ethics including violations of regulations or laws. The helpline is available anytime and can receive reports through an internal or external contact point established in collaboration with external experts (reports can be received by e-mail, phone, or letter in multiple languages). We also accept anonymous consultations and declarations.

We operate the Business Ethics Helpline in accordance with the Whistleblower Protection Act, which was revised in June 2022, and our internal reporting procedures clearly state that no reporter or investigation collaborator should be treated unfavorably due to their reporting or cooperation in investigative facts.

In addition, we have established a "Harassment Hotline", a common contact point for the KDDI Group for reporting and consulting on all forms of harassment, including sexual and power harassment, which is handled by external professional counselors.

We are actively promoting the use of the Business Ethics Helpline and the Sexual Harassment and Human Relationships Hotline by distributing whistleblowing cards.

In FY23.3, none of the consultations or reports received from entire KDDI Group companies concerned serious issues that required external declaration.

The KDDI Group Business Ethics Committee investigates the issues consulted on and reported as required while protecting privacy, and when the problems are detected, the committee members as well as the management team and the Audit & Supervisory Board members promptly review the report and take corrective actions along with measures to prevent recurrence.

Responsible Tax Practice

Basic Tax Policy

We at KDDI Group pursue the satisfaction and benefits of our customers while fulfilling our social responsibilities not only by complying with international rules and applicable tax laws and regulations in all operating countries and regions, but also by complying with and following the spirit of the law and paying tax appropriately to engage in tax fairness, and thereby strive to maximize corporate value.

In fiscal 2022, we paid 339,484 million yen of corporate income tax, which accounts for 31.4% of gross income. KDDI Group submits the Securities Report after undergoing accounting audits by external accounting auditors and obtaining approval of the CFO (Executive Vice President, Representative Director/Executive Director, Corporate Sector) and the President.

Tax Governance Structure

The KDDI Group Tax Management Regulations have been established to ensure that the KDDI Group steadily implements the Basic Tax Policy in its actual business activities. KDDI Group companies are required to comply with the regulations. The regulations were established by KDDI and are overseen by the Chief Financial Officer.

Practical operations are transferred to KDDI's tax division, which reports to the CFO and the necessary meetings bodies when it becomes aware of significant events or risks related to the KDDI Group's tax affairs.

Initiatives to Maintain and Improve Tax Governance

As KDDI Group businesses become increasingly multinational and have more international transactions, our top management, including the President, is working to develop and promote a tax strategy that properly recognizes international tax risks and regards such risk as an important issue that is directly linked to management, while utilizing external specialists to have a deeper understanding of the latest tax updates. In addition, the head office is engaged in education for employees across the world and receives tax practice support from external specialists. With these initiatives, we strive to maintain and improve tax governance. Also, with regard to the tax returns it prepares, KDDI has them reviewed by an external tax accountant corporation and obtains approval of the CFO before submitting them to the tax authorities.

Tax Transparency and Relations with Tax Authorities

To maintain the transparency of tax affairs, we prepare and submit an annual report on our activities by country in accordance with tax laws in Japan. We also work to build trust relationship with tax authorities in each country by conducting timely and appropriate disclosure of tax-related information, such as a business summary report on the overall status of the Group's activities in line with the relevant laws, regulations and disclosure standards of each country and region in which we operate. With these initiatives and prior inquiries as required, we strive to reduce tax risks.

Efforts to Prevent Tax Avoidance

In accordance with OECD's Action Plan on Base Erosion and Profit Shifting (BEPS), we are committed to ensuring proper tax payment in all operating countries including Japan, by aligning tax payments with the location of our economic activity and value creation, in line with the revision of tax regulations to tackle BEPS.

In particular, we handle transfer pricing taxation and anti-tax haven taxation, which are critical international taxation issues.

Transfer Pricing Tax Compliance

The KDDI Group's business is primarily in telecommunications and ancillary businesses in Japan, and its foreign-related transactions are few compared with those of other multinationals of similar size.

Where foreign-related transactions are conducted, the prudence of the foreign-related transaction is confirmed in compliance with the laws and regulations of the relevant countries, and transfer pricing documentation is prepared. Additionally, depending on the size of the foreign-related transaction, we pay the appropriate taxes by utilizing various systems in consultation with the tax authorities.

Tax Haven Tax Compliance

We do not use tax-free or low-tax jurisdictions (so-called "tax haven jurisdictions") for tax avoidance. When an investment is made in a tax haven area for business reasons, the anti-tax haven taxation system is applied following the laws and regulations of the relevant countries. If the company is subject to anti-tax haven taxation, it will file the appropriate tax return and pay the tax due.

Amount of Tax Paid

| FY2022 | ||

|---|---|---|

| Japan | 3,579 | 98.38% |

| UK | 20 | 0.55% |

| Mongolia | 11 | 0.30% |

| France | 8 | 0.22% |

| China | 5 | 0.14% |

| Others | 15 | 0.41% |

| Total | 3,638 | 100.0% |

Compliance Education, Training and Awareness Raising

Initiatives in FY2022

- Target: All KDDI employees

Promotion of the KDDI Group Philosophy - Target: All KDDI employees

Distribution of web shortcuts related to the KDDI Code of Business Conduct to business mobile devices lent to employees - Target: KDDI Group Business Ethics staff, etc.

Explanatory Seminar on the Revised Whistleblower Protection Act - Target: New line managers

Training related to bullying, harassment and compliance (e-learning) - Target: KDDI Group employees

Implementation of e-learning for KDDI employees to introduce the "KDDI Code of Business Conduct" and whistle-blowing case studies. The learning content will be deployed to KDDI Group companies.

Initiatives to Prevent Harassment

Initiatives in FY2022

- Dissemination of the KDDI Code of Business Conduct and thorough implementation of actions

- Training on harassment for department heads, group leaders, and line managers

- Accepting reports on the work environment, including instances of harassment, through the company's internal system

- Dissemination of report counters such as the Sexual Harassment Hotline and the Business Ethics Helpline by distributing whistleblowing cards to employees

- Responses to take when reported harassment cases have been substantiated

- Sustainability

-

- Environment

- Society

- Governance

- Mid-Term Sustainability Targets

- President's Message

- KDDI's Commitment to Sustainability

- KDDI's SDGs

- Integrated Sustainability and Financial Report

- ESG data

- Compliance

- Community Cooperation (in Japanese only)

- Social Contribution Activities

- Sustainability News (in Japanese only)

- External Recognition/Initiatives

- Recommended Contents

-