- KDDI HOME

Corporate Information

Corporate Information  Investor Relations

Investor Relations  Management Policy

Management Policy  Mid-Term Management Strategy

Mid-Term Management Strategy  Mid-Term Management Strategy (FY23.3-FY26.3)

Mid-Term Management Strategy (FY23.3-FY26.3)

Mid-Term Management Strategy (FY23.3-FY26.3)

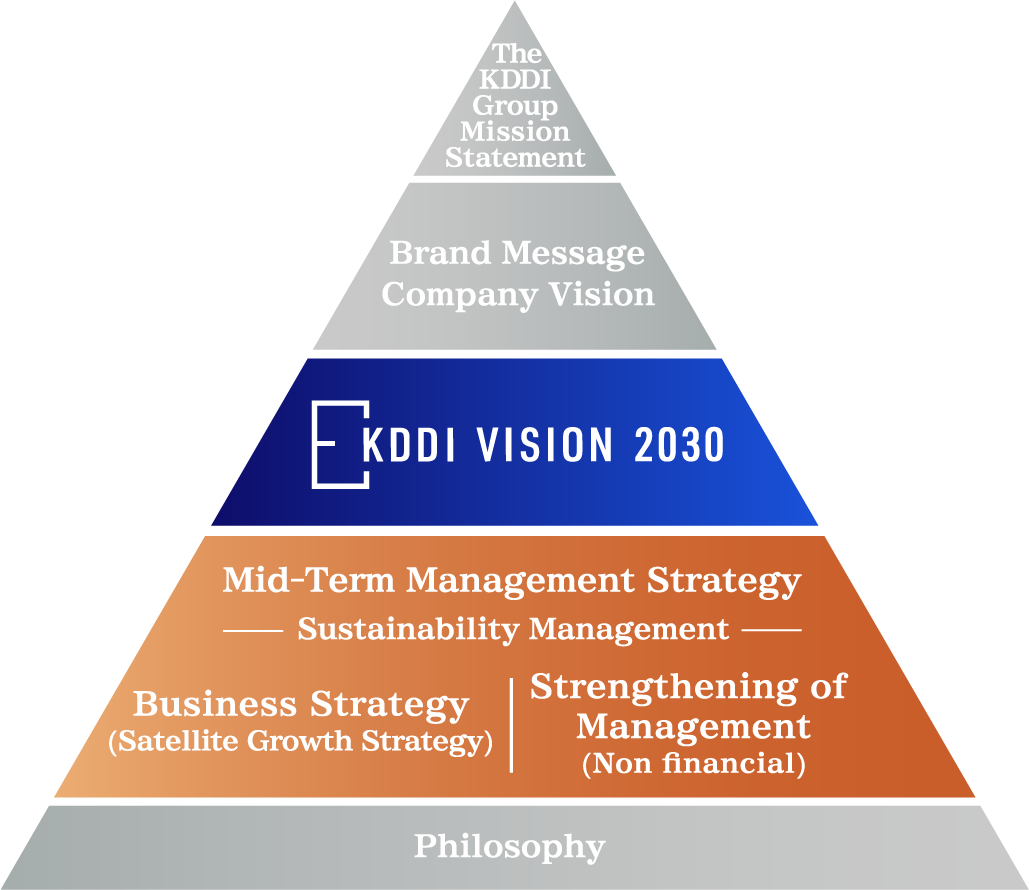

Aiming to achieve KDDI VISION 2030, we have established a Medium-Term Management Strategy for FY23.3 to FY26.3.

In May 2024, we updated the strategy to reflect changes in our business environment and circumstances, strengthening our efforts toward sustainable growth.

Amid significant changes in the business environment, KDDI has newly established "KDDI VISION 2030: The creation of a society in which anyone can make their dreams a reality, by enhancing the power to connect" as its vision for the future. By 2030, KDDI aims to be a "platformer that supports society," capable of delivering value-added across all industries and aspects of daily life. Until now, KDDI has expanded growth areas beyond telecommunications centered on smartphones through "the integration of telecommunications and life design". Under the new Mid-Term Management Strategy, KDDI will accelerate growth in telecommunications and value-added, with a focus on 5G, data, and generative AI, looking ahead to 2030.

The positioning of new Mid-Term Management Strategy (FY23.3-FY26.3)

As part of the positioning of the new Mid-Term Management Strategy (FY23.3-FY26.3), KDDI has first identified new material issues (materiality) from a long-term perspective, comprehensively addressing social challenges and the importance of these issues to the KDDI Group's management. Based on this, we place sustainability management at the core of our strategy and will promote both business strategy execution and the strengthening of the management foundation that supports it.

- Mid-Term Management Strategy

-

Defining new materiality and promoting the mid-term management strategy

- New Materiality

- Promotion of innovation centered on telecommunications

- Realization of safe, secure, and prosperous society

- Carbon neutral

- Strengthening the group management base

through progressing governance - Human resources first

- Advancing stakeholder engagement

Regarding the core concept of Sustainability Management, the KDDI Group aims to enhance corporate value and contribute to the sustainable growth of society by promoting business strategies and strengthening its management foundation in collaboration with our partners. We strive to create a virtuous cycle in which societal growth feeds into our next business strategies and is then returned to society once again.

- Sustainability Management

-

Working with partners to achieve sustainable growth and enhance corporate value

Business Strategy

To strengthen our strategy of telecommunications with value-added, we have updated our existing approach and formulated "New Satellite Growth Strategy."

This new strategy is based on 5G communications and centers on core businesses that promote data-driven practices and the social implementation of generative AI. In conjunction with these, we are advancing business domains that drive KDDI's growth, known as "Orbit 1" (DX, Finance, Energy), as well as future growth areas categorized as "Orbit 2" (Mobility, Space, Healthcare, Web3 & Metaverse, Sports & Entertainment), thereby promoting further business expansion.

Through the promotion of the New Satellite Growth Strategy, we aim to provide more accessible and diverse services both domestically and globally, contributing to the sustainable growth of society. In doing so, we strive to realize the vision set forth in KDDI VISION 2030: "The creation of a society in which anyone can make their dreams a reality."

- New Satellite Growth Strategy

-

Core

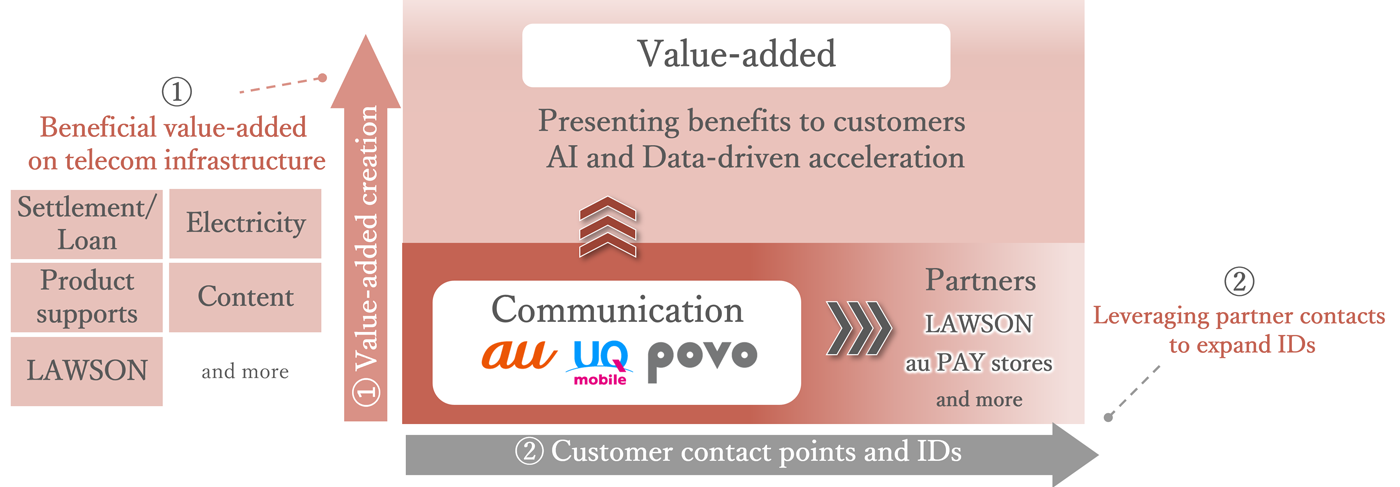

Going forward, it will be crucial to create value for our customers in order to drive revenue growth and improve retention.

We will advance our strategy of telecommunications with value-added, aiming to further ARPU revenues increase. This includes generating value-added through collaboration with Lawson and focusing on building a network that fully leverages the potential of 5G.

- Personal Business Growth Strategy

-

Focus on value-added creation and expansion of contact points

Strengthen proposals via AI and Data-driven

Total ARPU Increase × Retention

Orbit1⋅DX

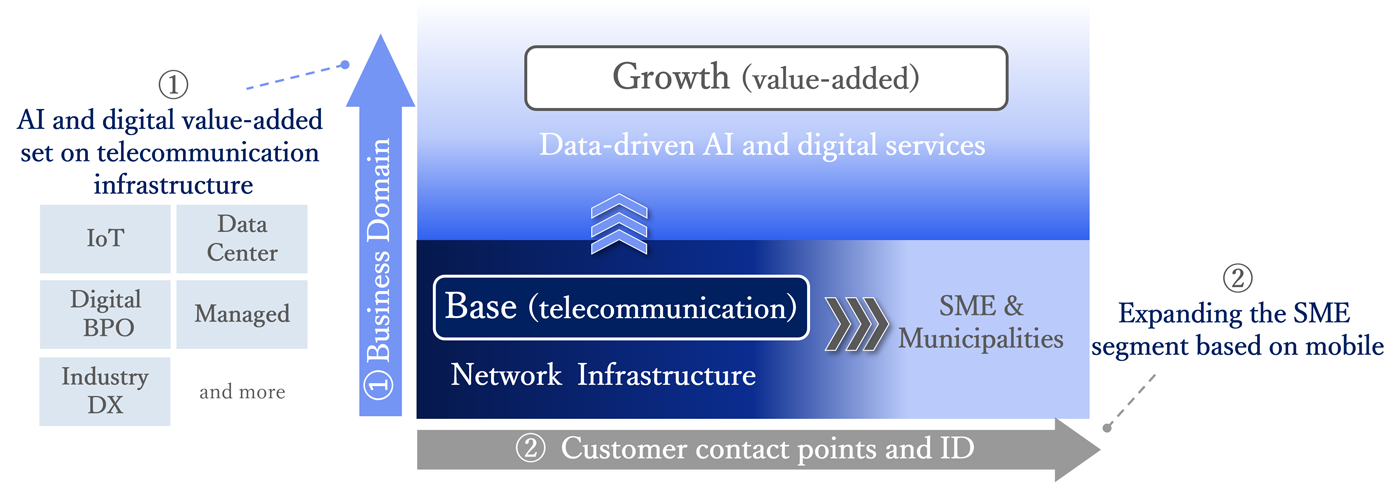

In the DX, Corporate business domains, we will continue to build upon our network and infrastructure foundation, just as we do in the Personal service segment, by expanding into growth areas such as IoT, data centers, and AI-driven digital value-added services. We also aim to increase the number of IDs by strengthening our approach to small and medium-sized enterprises.

Additionally, we are expanding our business domains and customer touchpoints through initiatives such as the launch of "WAKONX (in Japanese only)![]() ," a business platform designed for the AI era. By providing AI, data infrastructure, and network operations and maintenance as a one-stop solution, essential components for accelerating social DX, we aim to solve societal and industry challenges and support the business growth of our corporate clients.

," a business platform designed for the AI era. By providing AI, data infrastructure, and network operations and maintenance as a one-stop solution, essential components for accelerating social DX, we aim to solve societal and industry challenges and support the business growth of our corporate clients.

- Corporate Business Growth Strategy

-

Strengthen AI and data utilization

Expand business domain and customer contact points

Building high-margin model of telecommunication + value-added

Orbit1⋅Finance

In Financial business, performance has been strong, driven primarily by our robust customer base in banking and credit card services. At au Jibun Bank, which continues to earn strong customer support, we are steadily expanding our customer base while maintaining a balanced approach between deposits and loans.

Going forward, we aim to further grow our customer touchpoints and accelerate business expansion by enhancing each financial service and maximizing synergies with our telecommunications.

- Financial Business

-

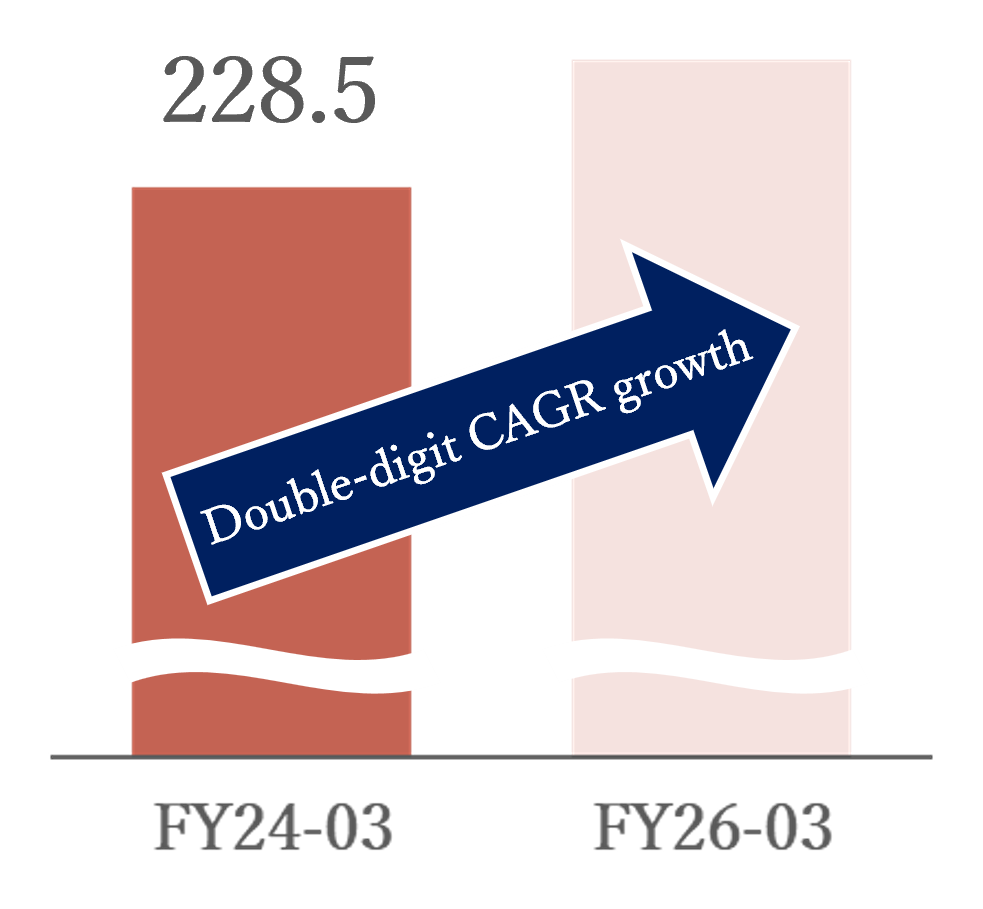

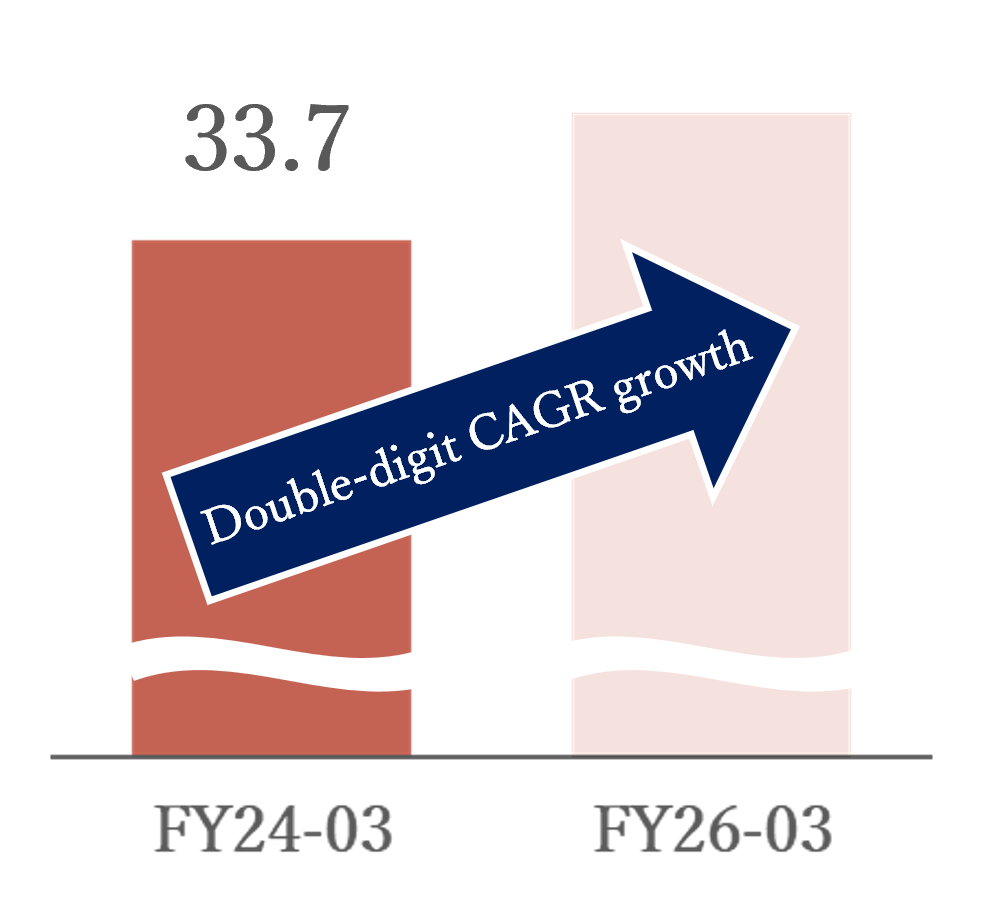

Double-digit CAGR growth by expanding business platform

centered on Bank and Credit cardPerformance

Double-digit CAGR growth centering on Bank and Credit card

Operating revenue

(Unit: billions of yen)

Operating income

(Unit: billions of yen)

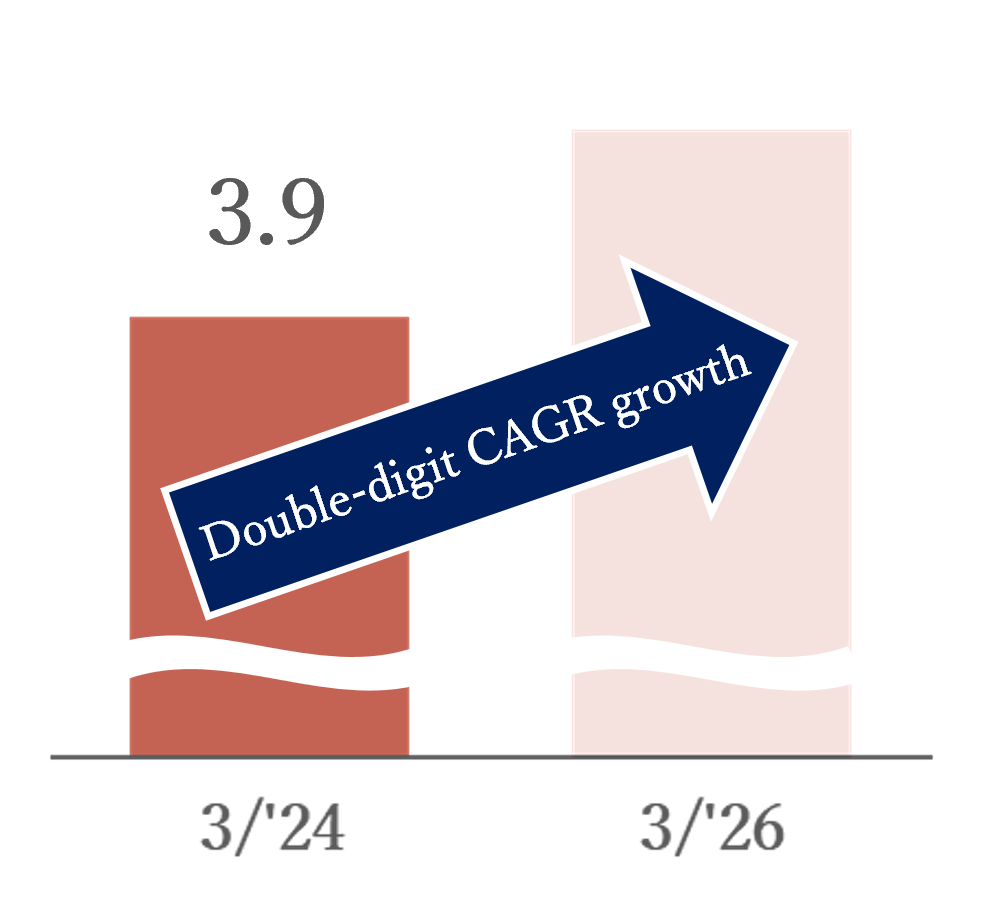

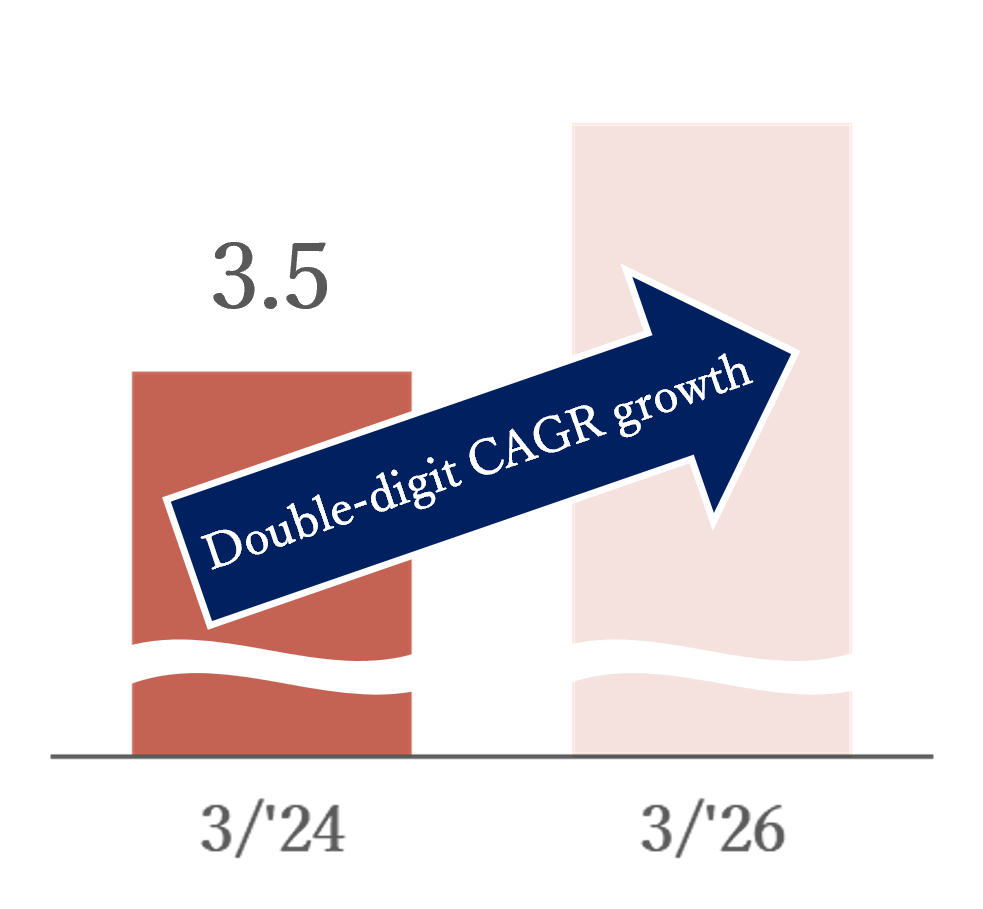

au Jibun Bank

Expand business balancing loan and deposit

Deposit balance

(Unit: trillion yen)

Loan balance

(Unit: trillion yen)

Exceed the number of Credit card members over 9.5 million [1] and Bank saving accounts over 6.0 million [1]

- [1]End of April 2024

- *au Financial Holdings (IFRS basis)

Orbit1⋅Energy

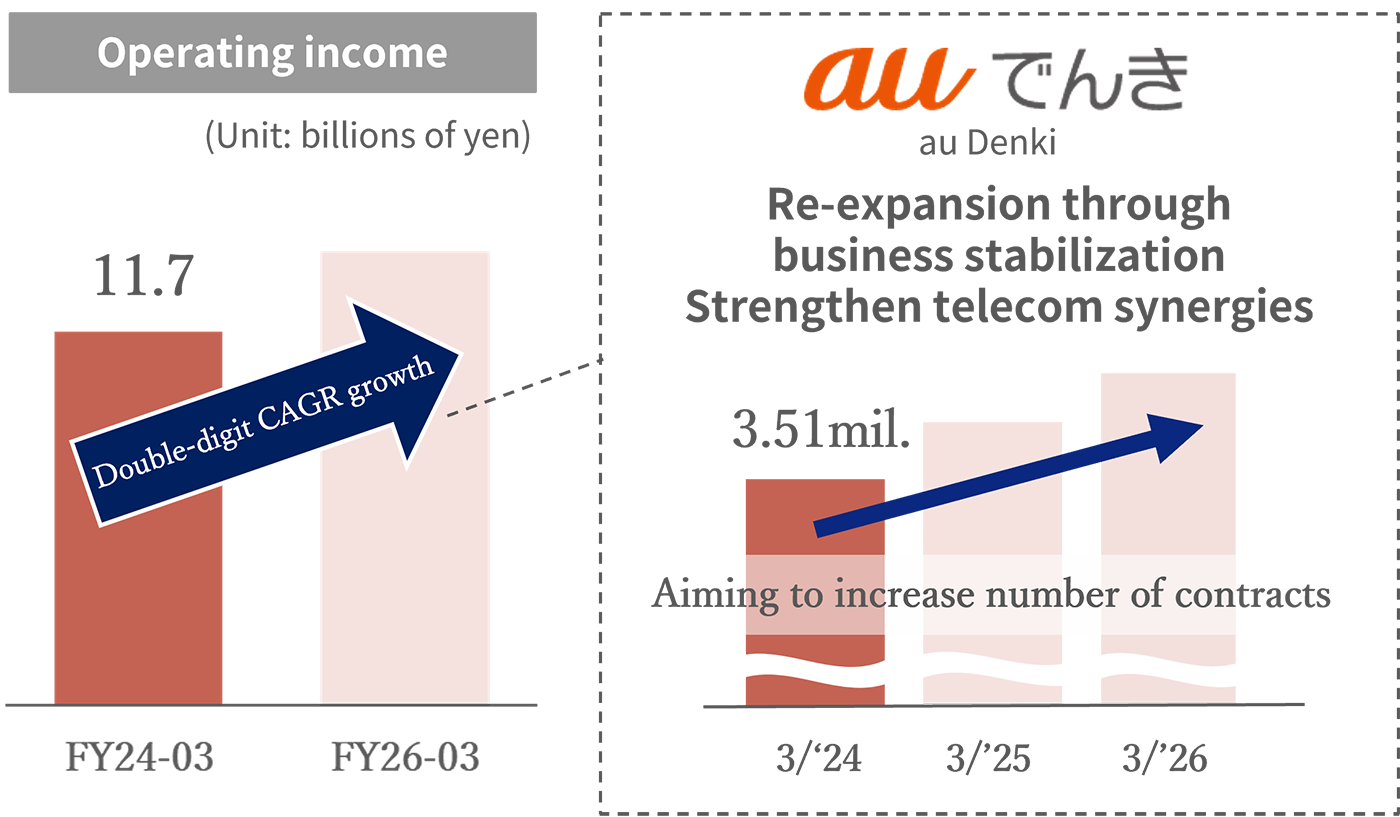

The Energy business has implemented initiatives aimed at stabilizing operations, resulting in an operating income of 11.7 billion yen for FY2024-03. The number of contracts for au Denki has also begun to increase. By leveraging synergies with telecommunications centered on au Denki, we aim to accelerate business growth.

In addition, through our group companies, we will strive to achieve both contributions to carbon neutrality and business growth.

- Energy Business

-

Maximize synergies with telecom through au Denki

and expand decarbonization-related businessesCommunication × Energy

Aiming for double-digit growth in operating income centered on au Denki

Decarbonization-related business

Carbon neutral contribution with growth

au Renewable Energy

- Focus on solar power accelerating development of renewable energy

- Growth through decarbonization support projects

Orbit2⋅LX

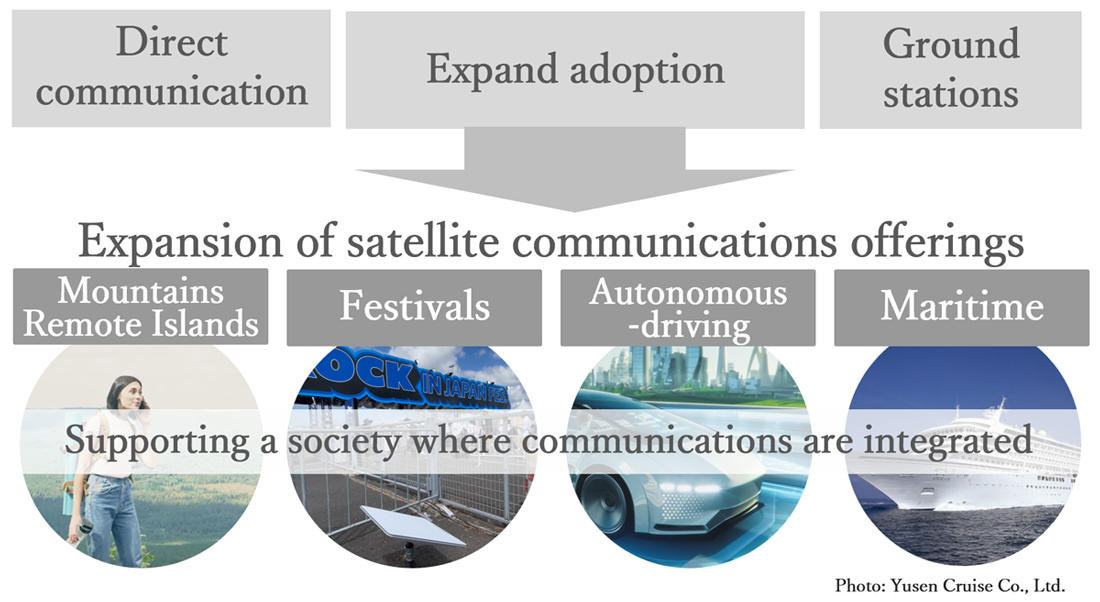

In the LX domain of Orbit 2, we aim to scale our business by combining our assets with those of our partners. Our partnership with SpaceX has entered its fifth year, and our collaboration continues to deepen. As a critical infrastructure supporting society, we will continue to expand the scope of our services.

We are also leveraging synergies with Lawson in the LX domain. In the entertainment area, we are creating new value by integrating our electronic ticketing platform with Lawson's entertainment services, expanding the number of events handled and enhancing customer engagement.

Furthermore, by combining KDDI's mobility-related services with LAWSON, we aim to improve the convenience of transportation and shopping in local communities.

- LX

-

KDDI and partners assets to scale businesses

Space

Deepening SpaceX partnership

Contribute to growth of KDDI BUSINESS

Scaling through partnering

Leveraging LAWSON assets to drive business growth

Entertainment

Linking e-ticket PF and entertainment services

Expand variety of events/

customer referralsMobility

Quick Commerce

Ride-hailing locations

Convenient regional transportation/

shopping- *LX: Life Transformation

Initiatives for Strengthening the Management Base

To accelerate the realization of a decarbonized society, we have established four environmental goals aimed at achieving net-zero emissions by the end of FY2040. The entire group is working together to meet these targets. To reduce Scope 1 and Scope 2 emissions, we are utilizing solar power provided by au Renewable Energy. In addition, we are engaging in dialogue with our business partners to reduce Scope 3 emissions.

In FY2025, we relocate our headquarters to a new office in Takanawa. We are developing various initiatives to foster a flexible work environment that is not bound by time or location, enabling collaboration among KDDI Group employees and external partners. Through this, we aim to cultivate a culture of co-creation and drive our transformation into a human resources first company.

- Strengthening of Management Base

-

Further strengthen management to support New Satellite Growth Strategy

Realization of carbon neutrality

Newly established Net-Zero targets including Scope 3

Accelerate each initiative to achieve targets-

FY2025

(Moved from FY2026)DC 100%

Renewable Energy -

NEW FY2030

Renewable Energy

with additionality 50% [2] -

FY2030

(Moved from FY2050)KDDI Group CN [3]

-

NEW FY2040

KDDI Group

Net-Zero [4]

Human Resources First

Move to new office in FY2025

Strengthen work-style reforms and growth support to promote co-creation

- [2]Non-consolidated basis

- [3]Consolidated basis; Scope1+Scope2+Scope3 CO2 emission is practically zero

- [4]Consolidated basis; Scope1+Scope2+Scope3

(See Decarbonized society)

-

In terms of cost efficiency, we will appropriately control investment levels while accelerating the deployment of 5G networks by promoting infrastructure sharing and leveraging advanced technologies. Additionally, we are transforming our sales structure and streamlining sales channels, targeting cost efficiencies of approximately 100 billion yen over the mid-term.

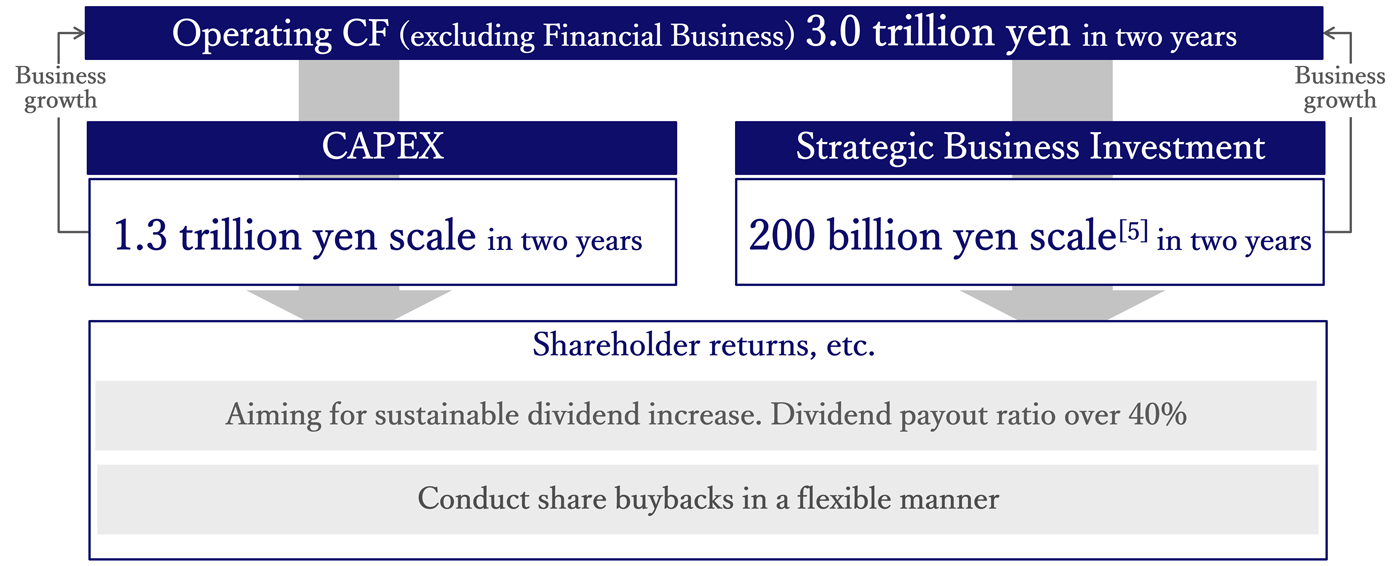

For cash allocation, we strive to balance growth investments with shareholder returns. Excluding financial business, we aim to generate approximately 3 trillion yen in operating CF over the two fiscal years from FY2025.3 to FY2026.3. This cash flow will be allocated to approximately 1.3 trillion yen in CAPEX and around 200 billion yen [5] in strategic business investments.

Regarding shareholder returns, we are committed to sustainable dividend increases and aim for a dividend payout ratio of over 40%. In addition, we will conduct share buybacks in a flexible manner.

- Cash Allocation Policy (FY25-03-FY26-03)

-

Aim to balance expanding operating CF and shareholder returns through growth investments

- [5]Exclude the tender offer and squeeze-out transactions of Lawson Co., Ltd.

Mid-Term Management Strategy Summary

- Summary

-

Towards

KDDI VISION 2030- Commit to "Enhancing the Power to Connect" and "Create new values by Digital data x AI"

- Promote a balance between CAPEX and OPEX levels through profit structure reform for technology

Update of Mid-Term Strategy

New Satellite Growth Strategy- Extended 1 year. Aim for EPS target for FY26-03, 1.5x compared to FY19-03

- Aiming for business growth and maximization of enterprise value by promoting Satellite Growth Strategy

- Sustainable growth of ARPU revenues and double-digit growth of operating income in focus areas

Consolidated Performance -

In FY26-03, aim for profit growth in each segment toward achieving EPS target

- Personal services segment

- : Challenge to create value exceeding customer expectations and improve LTV

- Business services segment

- : Shift resources to growth area based on a solid telecommunication foundation

Shareholder Returns - In FY26-03, DPS 80 yen (+7.5 yen) Aiming for 24 consecutive DPS growth

- Resolved the acquisition of treasury stock totaling 400 bil. yen (upper limit), of which, a tender offer for 350 bil. yen (upper limit)