- KDDI HOME

Corporate Information

Corporate Information  Investor Relations

Investor Relations  Financial Data

Financial Data  Result and Forecast

Result and Forecast

Result and Forecast

- About KDDI Business segments

- Result and Forecast

Consolidated Statement

Historical chart Operating revenue

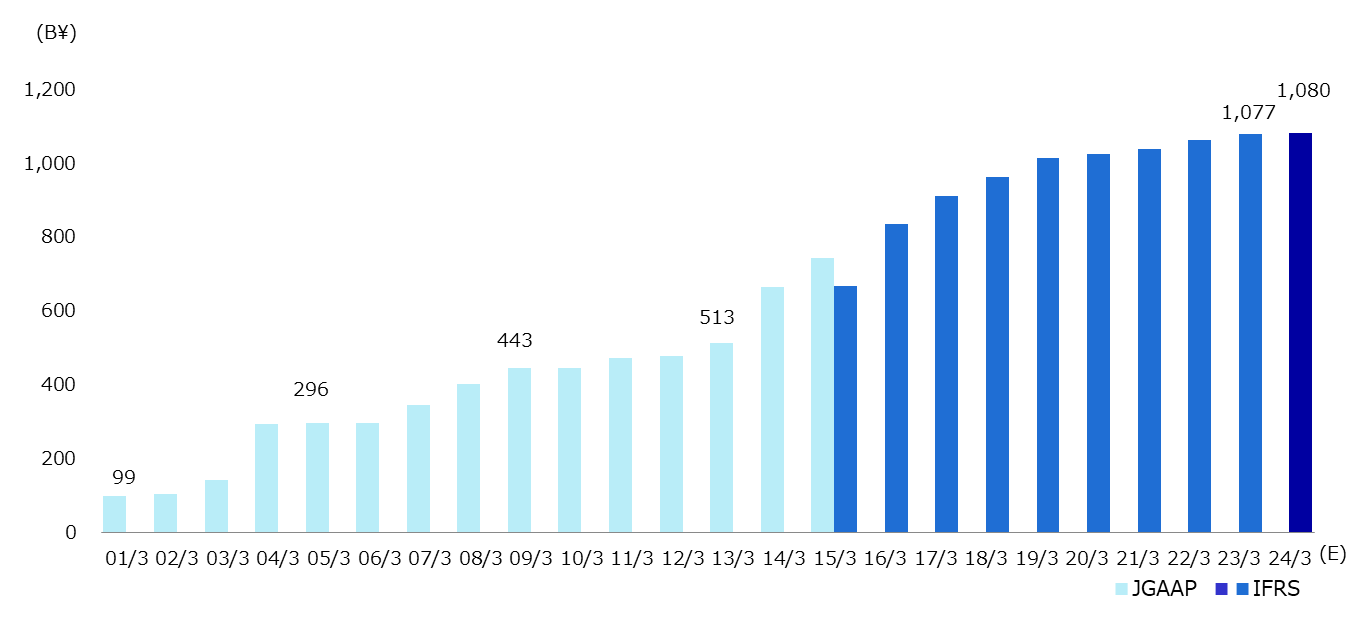

Historical chart Operating income

In the fiscal year ended March 31, 2024, consolidated operating revenue increased 1.5% year on year to 5,754.0 billion yen. Consolidated operating income was down 10.7%, to 961.6 billion yen.

The Company projects a consolidated operating revenue of 5,770 billion yen and an operating income of 1,110 billion yen for the fiscal year ending March 31, 2025.

Performance by Business segment

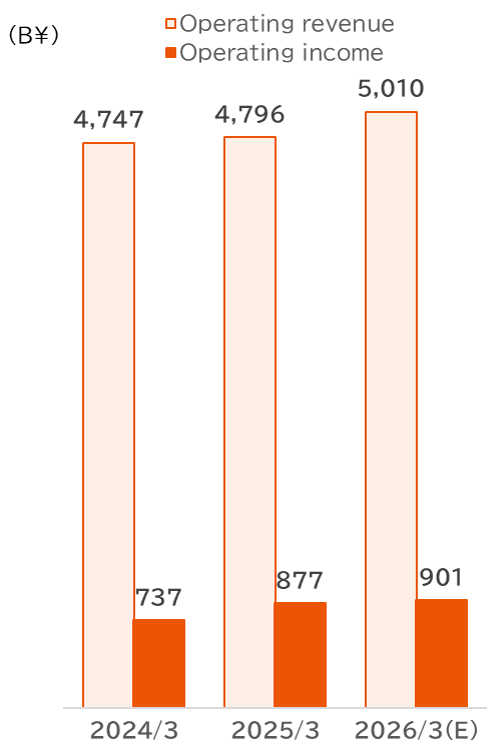

Personal Services

Results for FY 3/2024

In FY24.3, communications ARPU revenue reversed, and the financial and energy businesses also steadily grew.

Operating income decreased due to the temporary impact of Rakuten roaming income and provision for lease receivables for the Myanmar telecommunications business.

Forecast for FY 3/2025

The forecast for FY25.3 is that although there is a decrease in Rakuten roaming revenue, there is also an increase in reactionary effects from the previous year's one-off impact.

We aim to increase profits through positive communications ARPU and double-digit CAGR growth in the finance and energy businesses.

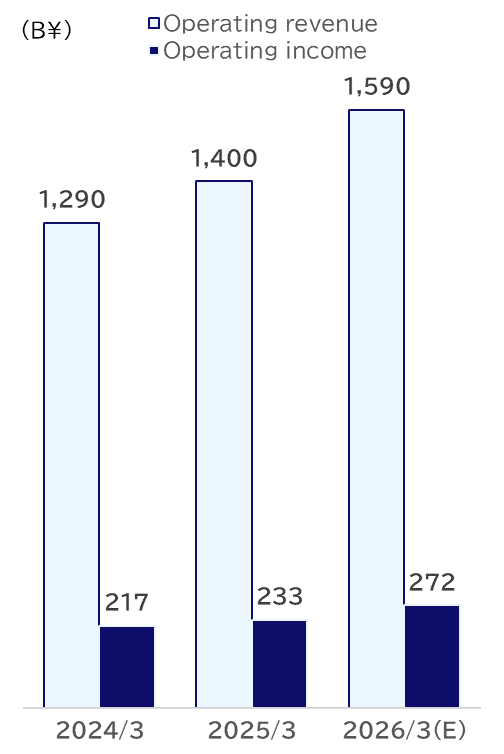

Business Services

Results for FY 3/2024

NEXT Core drove the increase in sales. We expanded the margin of profit increase in the 4Q and achieved double-digit growth.

Forecast for FY 3/2025

Our Growth Areas is expected to lead the double-digit growth in each category, and we aim to increase operating income by over 20% of consolidated operating income.

For more detailed financial information, please refer to the "Financial results presentation".

Presentations

Performance by Old Business segment

Click here for previous segment results for the fiscal year ended March 31, 2019.

- Performance by Old Business segment (- FY2019.3)

-

Personal Services

Performance of FY2019.3

Operating revenue increased by 0.3% year on year, due to factors such as increased energy revenues through business such as au Denki, as well as increased revenues at subsidiaries. These increased revenues compensated for the decrease in revenues arising from the unbundled plans (au Pitatto Plan and au Flat Plan) and the reduction in handset sales.

Operating income increased by 3.2% year on year, due to the increase in group MVNO revenues and the decrease in retirement of fixed assets, despite the decrease in mobile communications revenues [1] resulting from the new price plans (au Pitatto Plan and au Flat Plan) and the increased costs of handset sales.Life Deign Services

Performance of FY2019.3

Operating revenue increased by 11% year on year, driven by the growth of value-added ARPA revenues in connection with the increase in the au Smart Pass Premium subscription rate, as well as the growth in au Economic Zone Gross Merchandise Value, such as in the payment and e-commerce services.

Operating income increased by 8.4% year on year, also due to the increase in value-added ARPA revenues.Business Services

Performance of FY2019.3

Despite the continuing decrease of revenues from mobile and legacy fixed-line voice services, the operating revenue increased by 6.3% year on year, due to growth in the revenues of data communications, the data center business in Japan, the consolidated subsidiary KDDI MATOMETE OFFICE CORPORATION, and retail electric power sales.

Operating income increased by 23.1% year on year as a result of controlling the sales costs and sales management costs.Global Services

Performance of FY2019.3

Operating revenue decreased by 16.0% year on year, due to the effects of restructuring lower profitability business, even though there was steady growth in the Myanmar telecommunications business, the data center business, and the system integration business.

Operating income increased by 7.7% year on year, due to the steady progress in the Myanmar telecommunications business, the data center business, and the system integration business, despite the negative impact of the currency exchange rate.

- Other IR Information

- Recommended Contents

-