- KDDI HOME

Corporate Information

Corporate Information  Investor Relations

Investor Relations  IR Documents

IR Documents  IR Meetings

IR Meetings  IR Meetings: FY2024.3

IR Meetings: FY2024.3

IR Meetings

- Data Center Business presentation in Canada (Toronto)

- IR Meeting

(February 6, 2024) - Financial Business Meeting

Data Center Business presentation in Canada (Toronto)

| Date | March 25, 2024 |

|---|---|

| Location | Data center in Canada (Toronto) |

| Contents | Data center facility tour, presentation, and Q & A session |

| Participants | Investors and analysts |

| Presenters |

Data Center Business Description

At KDDI Group, we are expanding our data center business globally, focusing on high-quality connectivity data centers that make it easy for our customers, such as content providers, cloud service providers, and telecommunications companies, to interconnect.

We established "KDDI Canada, Inc." in June 2023, which took over the data center business from Allied Properties REIT in Canada, and our operation has begun in September 2023. By incorporating the connectivity No.1 data center business in Canada, we aim to expand our business across Europe, Asia, and North America, forming a trilateral expansion strategy.

<Data Centers in Canada>

<151 Front Street West>

<250 Front Street West>

<905 King Street West>

(Reference)

![]() Notice Regarding the Establishment of a New Subsidiary in Canada

Notice Regarding the Establishment of a New Subsidiary in Canada

Data Center Facility Tour

Participants visited one of the three data centers in Toronto, "151 Front Street West," which boasts the highest number of interconnections in Canada. While listening to the commentary of CEO Adachi, COO Kubo, Facilities Department Manager/Special Advisor Doug, and Director Mark, visitors have learned that it was a historic site where the first telegraph was sent in Canada. They have also seen our environmentally conscious air conditioning system, in which, through a partnership with Enwave, we prioritize the use of natural cooling using cold Lake Ontario water, and by using air conditioning equipment (such as chillers) as a backup, we are able to significantly reduce power consumption during normal operation.

<A bundle of yellow cables represents connectivity (connections)>

<Space for installing connectivity>

<Cooling device>

Main Q&As

-

How many connectivity data centers are there in North America?

How many connectivity data centers are there in North America?

While precise data is not available, it is considered that the data centers with 60 plus interconnections are connectivity data centers, which are operated in locations such as Los Angeles and San Francisco.

Among them, our data centers have strong advantages as they already host not only the three major carriers in Canada and numerous European and American carriers and internet service providers, but also host companies that contribute to the appeal of connectivity data centers, such as AWS and Microsoft. In terms of the number of connectivity (network service providers), our presence is dominant within Canada and is also the top tier in North America including United States being able to access nearly 300.

-

How many throughputs are there in data centers in Toronto.

How many throughputs are there in data centers in Toronto.

It is hard to estimate in terms of bandwidth since this information is closed in housed business operators. However, it can be inferred that a majority of domestic internet traffic flows through this data center's ecosystem based on the database as well as the population of Toronto.

-

How long is the contract period with the client companies?

How long is the contract period with the client companies?

The contract period is either 5 or 10 years. One advantage of the connectivity data center is its lower churn rate compared to data centers designed for hyperscalers because of its structure of the interconnected nature of the operators.

-

What are the differences between connectivity data centers and hyperscaler data centers in terms of locations and number of clients.

What are the differences between connectivity data centers and hyperscaler data centers in terms of locations and number of clients.

Hyperscaler data centers are often located in suburban areas due to their large scale. These centers primarily serve in-house use purposes, resulting in a small number of client occupants. On the other hand, connectivity data centers are frequently situated in urban areas, accommodating a larger number of client occupants due to their interconnected nature. Furthermore, it is expected that the number of connections will increase not only due to the growth in data traffic from video demand, but also due to the increasing number of related businesses.

-

What are the plans for capacity expansion supposing further market expansion and increase of demand are expected?

What are the plans for capacity expansion supposing further market expansion and increase of demand are expected?

Expanding capacity will require not only technology but also advancements in cooling systems. As the servers belong to our clients, capacity expansion also involves clients upgrading their equipment. We will consider the capacity expansion in line with our clients' needs.

-

How do you see the value of data centers in Canada? Are the profitability and the valuation both reasonable?

How do you see the value of data centers in Canada? Are the profitability and the valuation both reasonable?

EBITDA margin exceeds 50%, and the estimated EBITDA multiple is lower than the said to be level of about 30 times of data centers.

<Comments from participants>

- The data center tour was beyond my expectation.

- The presentation by KDDI CEO Adachi was excellent. The speakers politely addressed the questions from the investors and engaged in discussions on various aspects of the data center.

- Although I have been involved in IR activities across several sectors, including telecommunications, in long years, this was the best site visit tour I have ever participated in.

We have received many comments indicating a deeper understanding.

<References>

IR Meeting (February 6, 2024)

| Date | February 6, 2024 (Tue), 18:30-19:00 PM |

|---|---|

| Location | Online streaming |

| Description of presentation | Q&A Session on "Mitsubishi Corporation, KDDI CORPORATION, Lawson, Inc. have entered into the Capital Business Partnership Agreement" |

| Participants | Investors and Analysts |

| Panelists | Toshitake Amamiya, Executive Vice President, Representative Director, Executive Director, Personal Business Sector Hiroshi Takezawa, Managing Executive Officer, Executive Director, Marketing Division and Business & Services Development Division, Personal Business Sector Managing Executive Officer, CFO, Executive Director, Corporate Sector |

For presentation materials from the joint press conference held prior to this overview of the conference, please click bellow.![]() Presentation materials

Presentation materials

Summary

For details, please refer to ![]() the news release and

the news release and ![]() the timely disclosure (766KB).

the timely disclosure (766KB).

1. Outline

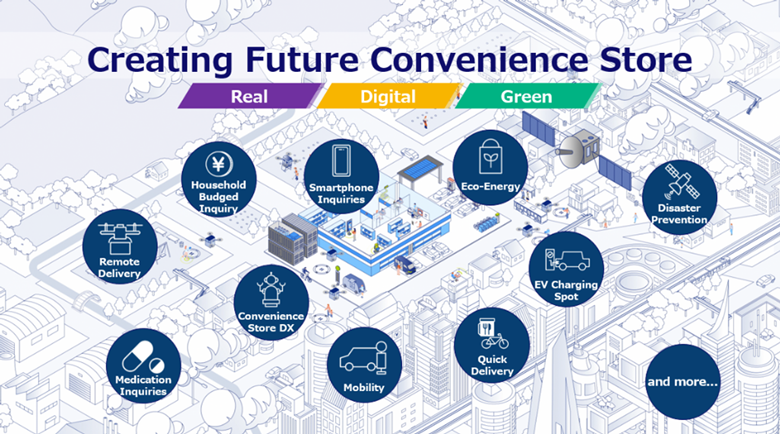

On February 6, 2024, Mitsubishi Corporation (MC), KDDI CORPORATION (KDDI), and Lawson, Inc. (Lawson), announced that the companies signed a capital business partnership agreement to aim for creation of new consumer values by integrating "Real, Digital, and Green" elements. Accordingly, KDDI will commence a TOB for Lawson in April 2024 and expect to complete the transaction around September (planned). If the closing occurs as planned, KDDI's ownership ratio in Lawson will be 50.0% (currently 2.1%), Lawson will be delisted, and for accounting purposes will be treated as a jointly controlled company by KDDI and MC.

The expected tender offer price per share is 10,360 yen, for a total amount of approximately 497.1 billion yen.

2. Objectives and Aims

For nearly five years since the capital and business alliance concluded in December 2019, KDDI and Lawson have been working on coordination to make their stores and services more attractive and expand the Ponta economic sphere. KDDI has approximately 31 million mobile IDs and 2,200 stores, and Lawson has 14,600 convenience stores and 10 million visitors per day, the implementation of this project will enable us to establish one of the leading consumer contact points in Japan with a total of approximately 17,000 stores.

In addition, KDDI and Lawson each have a number of group assets, such as entertainment and finance, that can provide synergies, as well as many of our own assets, such as insurance, Energy Business, and satellite telecommunications, that can help enhance the functionality of the convenience store, thereby expanding business opportunities by contributing to the realization of the convenience store of the future.

The decision to support Lawson's growth strategy was based on the belief that supporting Lawson's growth strategy will lead to the strengthening of the infrastructure function of convenience stores, which in turn will enhance the corporate value of the two companies.

3. Vision⋅Obtainable synergies

The companies will consider measures to enhance convenience store functions, improve the customer experience value combined with the latest technology, achieve greater efficiency in store operations, and achieve a green and sustainable consumer society. Specific measures will be discussed in depth after closing, but we will promote business coordination in the three business areas of Real, Digital, and Green, leveraging the assets and strengths of each company.

(Reference) Examples of coordination measures

- Providing new services such as telecommunications, banking/insurance, and health care through online remote customer service to improve convenience at LAWSON stores.

- Making LAWSON stores smarter and more advanced through the use of the latest technologies such as DX, XR, and remote delivery.

- Converting LAWSON stores into disaster prevention and preparedness centers through the installation of solar power generation and EV charging spots, and the use of satellite telecommunications.

Q&A Session

In the Q&A session, the answers to questions from the participants were provided.

Questioner 1

-

What will change now that KDDI will increase its stake in Lawson to 50%? I would like to ask about both the governance aspect, such as whether it will become a consolidated subsidiary or whether its involvement in Lawson will change, and the business aspect, such as what will change in terms of the synergies that have been created through Ponta until now.

What will change now that KDDI will increase its stake in Lawson to 50%? I would like to ask about both the governance aspect, such as whether it will become a consolidated subsidiary or whether its involvement in Lawson will change, and the business aspect, such as what will change in terms of the synergies that have been created through Ponta until now.

Although it will be 50% owned, it will not become a consolidated subsidiary, but a jointly controlled company, taking in 50% of net profits. We are also considering dispatching directors to the company, which will make it easier for us to communicate our intentions, and we believe that this will enable us to make even greater efforts than before.

In terms of business, we would like to first consider building up Lawson's growth well. We will provide our assets and collaboration to Lawson, and Lawson will provide them to its customers. Helping Lawson's repeat use will lead to Lawson's growth, which in turn will lead to our return. We believe we can offer the various solution businesses we do as well.

For example, if we provide IoT to an automobile company, and the automobile company provides services using IoT to its customers, the automobile company will grow, and we will get significant returns from that growth as a solutions business. Likewise will happen.

On a personal business basis, Lawson has 14,600 stores and receives 10 million customers per day. KDDI have 2,200 stores and over 31 million customers, but we need to strengthen our points of contact with customers. Customers come to our stores when they change their models, and we want to give them more opportunities to interact with us and understand our various services and products during that time. We would like to discuss specific details in the future as part of the business cooperation contract with Lawson.

-

What you expect from a business is that the frequency of customer contact will lead to the next piece of business?

What you expect from a business is that the frequency of customer contact will lead to the next piece of business?

You may understand it that way. We will do various things at those points of contact. Remote customer service is one of them, as well as showing our products and expanding them through digital coordination.

-

The mid-term Management Strategy has a plan of 700 billion yen for strategic business investments, and so far KDDI have spent about 200 billion yen, which will be used up in this instance by about 500 billion yen. Given the expected sale of shares held by major shareholders, I would like to know what you think about cash flow.

The mid-term Management Strategy has a plan of 700 billion yen for strategic business investments, and so far KDDI have spent about 200 billion yen, which will be used up in this instance by about 500 billion yen. Given the expected sale of shares held by major shareholders, I would like to know what you think about cash flow.

As a cash allocation in our mid-term Management Strategy, we have given guidance of 700 billion yen for strategic business investments. As you understand, we have invested approximately 200 billion yen so far, so in this instance the amount will be roughly 700 billion yen. However, the 700 billion yen figure is only a guidance, and we will make decisions on individual projects as they emerge. At the moment, however, there are no large-scale projects that follow this one. We will consider this matter in light of the future situation.

With regard to responding to major shareholders, there is no change in the concept of responding to shareholder returns in relation to the guidance in the mid-term plan. The first step in shareholder returns is to pay a stable dividend, followed by flexible share repurchases. Since we have a dialogue with our major shareholders, we would like to respond to them as much as possible within the context of shareholder returns in the cash allocation section of the medium-term management plan.

Questioner 2

-

I would like to ask you to summarize the concept of the premium for the deal and the financing in this instance.

I would like to ask you to summarize the concept of the premium for the deal and the financing in this instance.

Will it be debt financing? Will there be any impact on the credit rating? From the calculations, the premium appears to be low, how valuations were calculated?

First of all, regarding financing, which will be in next term, we plan to basically respond by debt financing through bank borrowing or corporate bonds. The details of procurement will be discussed after reviewing the overall cash flow plan of next term.

The price was determined through multiple discussions between Lawson's special committee and KDDI, with each company validating the premium over Lawson's market price from multiple perspectives, based on the results of calculations in the stock company valuation report each company obtained from a third party, checks by the special committee for validity, and analysis of industry trends, and Lawson's business potential, and its growth. We believe that this is a reasonable result.

-

How did you consider ROIC? Also, how did you consider the cost of equity? The calculation is roughly 5%, which may be off-balance sheet since it is not consolidated, but it is a deal that will be dilutive for KDDI. How would you create synergies, particularly cost synergies, which seem unlikely?

How did you consider ROIC? Also, how did you consider the cost of equity? The calculation is roughly 5%, which may be off-balance sheet since it is not consolidated, but it is a deal that will be dilutive for KDDI. How would you create synergies, particularly cost synergies, which seem unlikely?

Regarding the ROI, we expect it to be about 5% based on the current profit base alone. We believe that growth effects from synergies will be added to this. The first is synergies for Lawson, which we believe will lead to growth through the utilization of KDDI's assets. In addition, there will be synergies for KDDI. We believe that the addition of these synergies, which include synergies in the personal services and solutions businesses, will have a sufficient investment effect of 5% plus alpha.

-

Are cost synergies possible? For example, is it possible to reduce costs by integrating stores?

Are cost synergies possible? For example, is it possible to reduce costs by integrating stores?

Cost synergies are not really considered. Rather, synergies on the revenue and top line side.

Questioner 3

-

I feel uncomfortable with KDDI's inclusion of the retail business as a co-owner. KDDI, an infrastructure company, and Mitsubishi Corporation, an investment company, both without retail experience, will become the owners and roll out the business with Lawson. It may not necessarily easy to gain the understanding of investors regarding this collaboration among the three companies. How long do you expect investors to understand that the investment was a success?

I feel uncomfortable with KDDI's inclusion of the retail business as a co-owner. KDDI, an infrastructure company, and Mitsubishi Corporation, an investment company, both without retail experience, will become the owners and roll out the business with Lawson. It may not necessarily easy to gain the understanding of investors regarding this collaboration among the three companies. How long do you expect investors to understand that the investment was a success?

Retail and telecommunication, trading companies may seem like different fields, but in this disaster, we recognized that modern convenience stores are a significant presence as social infrastructure. Especially in rural areas, they are indispensable. By combining our digital expertise, including telecommunications, we believe that we can contribute to society and, as a result, build strong relationships with customers and provide new value-added offerings.

KDDI, which has no experience in retailing, will not include this in the scope of consolidation, while MC has knowledge of the retail business. We believe that the three companies with their respective expertise can come together to create new services and value-added products, including those that contribute to society.

I can't give you a specific time frame for success, as we will be discussing that in the future, but I am sure you will recognize it in the not-too-distant future.

-

If KDDI simply add approximately 500 billion yen in additional investments in this instance to the disclosed value of NetDebt of just under 2 trillion yen, which is approximately 2.5 trillion yen, the NetDebt/EBITDA multiple would be a calculation of approximately 1.7x, based on KDDI's EBITDA of approximately 1.5 trillion yen. This gives the impression that the company has less room for growth investment on its balance sheet. I would like to know your perspective on balance sheet leverage in this area.

If KDDI simply add approximately 500 billion yen in additional investments in this instance to the disclosed value of NetDebt of just under 2 trillion yen, which is approximately 2.5 trillion yen, the NetDebt/EBITDA multiple would be a calculation of approximately 1.7x, based on KDDI's EBITDA of approximately 1.5 trillion yen. This gives the impression that the company has less room for growth investment on its balance sheet. I would like to know your perspective on balance sheet leverage in this area.

We recognize that the NetDebt/EBITDA multiple has been very low in the past, and is now slightly higher due to the rollout of the finance business.

From the current credit rating maintenance policy, we consider approximately 1x as a benchmark, but we recognize that it is acceptable to exceed 1x temporarily in M&As like this time, as it is explainable. This can be explained in terms of accumulating cash in the future to bring the ratio as close to 1x as possible again, and it does not mean that the ratio should not exceed 1x. We are also aware that we still have the capacity to invest given our current strength.

However, M&A investments are not a continuous occurrence, and we will consider each project.

Questioner 4

-

KDDI say it is jointly controlled, but will it be accounted for as the equity method? Will it be same for Mitsubishi Corporation? Under IFRS, I believe the equity method is included in operating income. Will it be included in operating income?

KDDI say it is jointly controlled, but will it be accounted for as the equity method? Will it be same for Mitsubishi Corporation? Under IFRS, I believe the equity method is included in operating income. Will it be included in operating income?

On the P/L, with the equity method, it is included in the operating income (loss) under IFRS. Since after-tax profit is captured, it will directly affect net income. Mitsubishi Corporation also uses the equity method.

-

I would like to ask a little more about synergies. What can you do to contribute to Lawson's growth and what is a contribution to KDDI's Personal business growth?

I would like to ask a little more about synergies. What can you do to contribute to Lawson's growth and what is a contribution to KDDI's Personal business growth?

At today's press conference, We mentioned three points: "Real x Digital x Green".

Real, as I mentioned earlier, the two companies will have about 17,000 real contact points. This increases the opportunity to recommend various services to customers, and also to offer new areas of service remotely.

In regard to Digital, we would like to work with Lawson to see what kind of chemical reactions we can create by combining our customers' 1st party data with Lawson's data. Lawson is mainly in the convenience store business, but we understand that they also have assets similar to ours, such as entertainment, high-end supermarkets, and finance, and we believe that we can create synergies with them in these value-added areas.

Regarding Green, Lawson has already installed solar panels in its stores. We are also promoting renewable energy and other initiatives through au Energy Holdings, and we are considering creating synergies here as well.

-

Does a 50% stake mean that you will be able to do so? You mentioned governance and resource knowledge, but what does 50% ownership mean?

Does a 50% stake mean that you will be able to do so? You mentioned governance and resource knowledge, but what does 50% ownership mean?

The 50% stake means that we are committed to Lawson's growth, and we believe that by jointly managing the company with Mitsubishi Corporation, we will be able to roll out more in-depth measures at a much faster pace than before. KDDI is now coordinating with Lawson, but I believe that a 50% joint partnership will speed up the process of deciding on the frame for each collaboration and enable us to provide new services to customers more quickly.

Questioner 5

-

Are there any contracts, for example, that KDDI will be exclusive in this area by holding 50% of the shares? At the press conference, it seemed as if the Lawson side did not particularly want to give KDDI an advantage over SoftBank or NTT Docomo, as this is a decision to be made by the customers.

Are there any contracts, for example, that KDDI will be exclusive in this area by holding 50% of the shares? At the press conference, it seemed as if the Lawson side did not particularly want to give KDDI an advantage over SoftBank or NTT Docomo, as this is a decision to be made by the customers.

As Lawson gave an overview of, the priority is for customers to be able to use the system conveniently and not exclusively. However, we believe that a deeper understanding between each company will be achieved by sending board members and employees from KDDI to understand what customers are looking for and what services they would choose. In this sense, the increase in our ownership ratio from 2.1% to 50% is significant.

-

You said the first benefit is that it will increase Lawson's corporate value, but will it increase its profit or its asset value?

You said the first benefit is that it will increase Lawson's corporate value, but will it increase its profit or its asset value?

Basically, it means that Lawson will do what it takes to improve its profits and we will take it in.

-

I feel that the profit is small in relation to the 500 billion yen investment, but I would like to know how much of an increase in income is expected, if any calculations have been made.

I feel that the profit is small in relation to the 500 billion yen investment, but I would like to know how much of an increase in income is expected, if any calculations have been made.

We will work on this from now, so please bear with us for now.

Financial Business Meeting

Materials

Financial Business Presentation Meeting

| Date | August 29, 2023 (Tue), 4:00-5:15 PM |

|---|---|

| Location | Online streaming |

| Description of presentation | KDDI's Financial Business |

| Participants | Investors and Analysts |

| Panelists | Toshitake Amamiya, Executive Vice President, Representative Director, Executive Director, Personal Business Sector Hiroshi Takezawa, Managing Executive Officer, Executive Director, Marketing Division and Business & Services Development Division, Personal Business Sector Tomohiko Katsuki, President, Representative Director, au Financial Holdings Corporation |

Q&A Session

In the Q&A session, the panelists provided answers to questions from the participants.

Questioner 1

-

-

What is the level of profitability of au Financial Holdings on a stand-alone basis compared to other new banking groups?

What is the level of profitability of au Financial Holdings on a stand-alone basis compared to other new banking groups?

Regarding ROE, although we cannot answer directly, Rakuten Bank and SBI Sumishin Net Bank have ROEs of 13.8% and 14.3%, respectively, and although we have not reached those levels, we have reached 8%, which is the acceptable level for Japanese companies as stated in the Ito Report. We would like to work on our future growth strategy, which I gave an overview of today, to reach the level of our competitors Rakuten Bank and SBI Sumishin Net Bank.

-

-

-

I believe that conducting financial business within KDDI Group will create synergies with the telecommunications business, but how much profit is it contributing to the KDDI Group? For example, you gave an overview of the figures for the decrease in churn rate and the increase in communication ARPU, but I would like to know how much profitability as a group is being demonstrated as a result of this.

I believe that conducting financial business within KDDI Group will create synergies with the telecommunications business, but how much profit is it contributing to the KDDI Group? For example, you gave an overview of the figures for the decrease in churn rate and the increase in communication ARPU, but I would like to know how much profitability as a group is being demonstrated as a result of this.

We know that the churn rate can be reduced by overlapping the use of finance services. The first point is that there are still customers who do not use financial services, and by encouraging these customers to use au Money Activity Plan, the churn rate will fall, which will contribute to revenue.

As stated on page 29 of the presentation materials, we have given an overview of our drive forward for 5G, which is to increase ARPU by raising the ratio of unlimited use plans. We believe that au Money Activity Plan will further increase the ratio of unlimited use plans and raise the overall ARPU.

We would like to keep an overview of how much au Money Activity Plan contributes to the increase in ARPU and the scale of revenue due to the decrease in churn rate and gave an overview of how much the au Money Activity Plan contributes to ARPU.

-

-

-

We believe that promotion is necessary to provide new value. Points and preferential interest rates are ways to do this, but how much of the cost is shared between KDDI and au Financial Group? If KDDI bears all the burden, is it limited to au Money Activity Plan?

We believe that promotion is necessary to provide new value. Points and preferential interest rates are ways to do this, but how much of the cost is shared between KDDI and au Financial Group? If KDDI bears all the burden, is it limited to au Money Activity Plan?

Since au Money Activity Plan is a telecom service that utilizes financial services, the promotion will be conducted by KDDI. au Money Activity Plan is not eligible for the family discount, and the cost allocated for the family discount is diverted to provide new value to make it more attractive. KDDI will bear the burden when telecom services are involved, and au Financial Group will bear the burden when various benefits are offered by au Financial Group.

-

Questioner 2

-

-

Regarding au Jibun Bank, please explain the background to the expansion of the mortgage loan balance and the reasons why it continued to expand in FY24-03 Q1. Also, please explain whether the mortgage loan balance has impacted KDDI's consolidated balance sheet.

Regarding au Jibun Bank, please explain the background to the expansion of the mortgage loan balance and the reasons why it continued to expand in FY24-03 Q1. Also, please explain whether the mortgage loan balance has impacted KDDI's consolidated balance sheet.

As shown on page 18 of the presentation materials, the reason for the rapid expansion of mortgage loan disbursements is that interest rates are 0.319% annual for any telecom company users, which is the lowest level in the online banking industry. In addition, there is the fact that the company offers a full range of group credit life insurance, which is insurance specifically designed for mortgages. For example, the company's insurance coverage, which reduces the mortgage loan balance by half in the event of a cancer diagnosis, has been highly evaluated, and has been acquired first place in a ranking by external specialists. The company believes that the 0.319% interest rates, including this insurance handling fee, were well received by customers.

In the Bank of Japan's "Survey on Lifestyle Awareness," there is a significant difference in the ratio of respondents who are concerned about their old age between non-homeowners and homeowners. For example, 51% of non-homeowners are worried about their old age, while 34% of homeowners are worried about their old age, which is a very significant difference. In light of this survey, I think the bank is highly evaluated for its support for owning houses and mortgages, which are the basic infrastructure of life, and for offering attractive interest rates and insurance coverage based on the efficiency that only an online bank can provide.

-

-

-

Savings accounts are expanding, but I would like to know the purpose of the deposits of those who are depositing about 500,000 yen per account. Are they depositing to be used for daily settlements or are those who have mortgages doing so to secure liquidity? If it is not used much for settlement, will these savings accounts be churned out?

Savings accounts are expanding, but I would like to know the purpose of the deposits of those who are depositing about 500,000 yen per account. Are they depositing to be used for daily settlements or are those who have mortgages doing so to secure liquidity? If it is not used much for settlement, will these savings accounts be churned out?

Even if we simply calculate the average loan balance of about 2 trillion yen for mortgages at an average loan amount of 20 million yen, it does not amount to that many accounts. 2.3 trillion yen in deposit balance at an average deposit amount of 500,000 yen per account means that the reality is that nonmortgage customers have most of deposits at au Jibun Bank.

Starting in 2021, au Jibun Bank is offering preferential au collective interest rates through au PAY, direct debit of au PAY Card from au Jibun Bank, and coordination with au Kabucom Securities.

For yen savings accounts, the interest rate is 0.001% per year in a low interest rate environment, but au Jibun Bank offers a savings account interest rate of 0.2% when these three are used as a set. The situation is that customers have a natural inclination to deposit in an account with good performance if they are going to place their funds, and the volume of deposits is increasing.

We are seeing trends, that customers are making good deposits and withdrawals. They are actively using their accounts and we do not expect a sudden drop in deposits.

-

-

-

I understand that KDDI bears the promotion burden for the au Money Activity Plan.

I understand that KDDI bears the promotion burden for the au Money Activity Plan.

If au Jibun Bank bears the cost, is the bank in a profitable position? Mortgage payments take 20 to 30 years. If KDDI decides that financial services are not suitable for retention and acquisition of au users in the future, or if bundling is no longer possible due to government regulations, please gave an overview of whether au Jibun Bank will be viable on its own.

The 0.2% annual interest rate on yen savings accounts with the preferential au collective interest rate is an open measure, and au Jibun Bank bears the deposit interest rates and pays interest to customers.

The additional 0.1% interest rate of the 0.3% annual interest rate on Yen Savings accounts for au Money Activity Plan is borne by KDDI and does not impact au Jibun Bank's total asset interest margin, as it is a matter of neutrality and fairness for the financial institution.

In addition, for the lending side mortgage interest rates, au Jibun Bank is offering 0.319% annual for the base open interest rate. Measures to further reduce interest rates, such as au Preferential Interest Rate Discount and the cost of reducing interest rates through further alliances with J:COM and ctc, are measures that go one step further than open, and are achieved by sharing the cost with the group telecommunications companies. This also has no impact on au Jibun Bank's total asset margin. We are working in coordination with KDDI to design operations and systems that will ensure a stable interest margin on total assets, and we have firmly incorporated this into our operations.

-

-

-

What percentage of mortgage contractors are KDDI users?

What percentage of mortgage contractors are KDDI users?

Although specific figures are not disclosed, the company is attracting customers with open and low interest rates, and the ratio of au users tends to increase, although it is not far from the market share. Now, au Preferential Interest Rate Discount has gained considerable recognition, and the use of mortgages by au users is increasing.

-

Questioner 3

-

-

On page 32 of the presentation materials, you state that you are aiming for a 10% level of consolidated operating income growth in the financial business. I would like to know your thinking on whether you will keep an eye on the balance and increase profits gradually, or whether you are considering investments while allowing for a temporary decline in income in view of your plans to expand bank accounts and credit card business membership considerably.

On page 32 of the presentation materials, you state that you are aiming for a 10% level of consolidated operating income growth in the financial business. I would like to know your thinking on whether you will keep an eye on the balance and increase profits gradually, or whether you are considering investments while allowing for a temporary decline in income in view of your plans to expand bank accounts and credit card business membership considerably.

Basically, as stated on page 32 of the presentation materials, we do not expect any decline in income, and would like to continue to increase in income.

-

-

-

How do you plan to increase the goals of 15 million bank accounts and 15 million credit card members? If you are not concerned about the time frame, what is the premise of your plan, whether it assumes that you can accumulate enough through cross-selling with telecommunications, or whether it implies that you will acquire them from other companies' economic spheres as well. Do you have a concrete image?

How do you plan to increase the goals of 15 million bank accounts and 15 million credit card members? If you are not concerned about the time frame, what is the premise of your plan, whether it assumes that you can accumulate enough through cross-selling with telecommunications, or whether it implies that you will acquire them from other companies' economic spheres as well. Do you have a concrete image?

We believe that we will increase the number of customers mainly from the KDDI Group, but basically the business conducted by the au Financial Group is open, and we are assuming that customers other than KDDI Group telecom users will also use financial services. We are setting our goals toward the level of 14 million accounts for Rakuten Bank and 17 million members for DOCOMO's Credit card, while building up several specific measures.

-

Questioner 4

-

-

Regarding page 30 of the presentation materials, you gave an overview of the effect of reducing au churn rate in multiple use of financial services, but conversely, what are the reasons why people would cancel their au accounts even if they use multiple financial services?

Regarding page 30 of the presentation materials, you gave an overview of the effect of reducing au churn rate in multiple use of financial services, but conversely, what are the reasons why people would cancel their au accounts even if they use multiple financial services?

Some users have an au line, Credit card, and banking account, but are not active users. We believe that there may be some cancellations due to inactivity, which may result in some cancellations without the benefits of using multiple services. As for telecom contracts, some users will cancel their contracts, while others will be forced to cancel, resulting in some cancellations.

-

-

-

Regarding the expansion of loans on page 17 of the presentation materials, the note states that the liquidation portion of mortgages is excluded, but I would like to know the past track record of liquidation and your thoughts on what kind of policy you intend to pursue.

Regarding the expansion of loans on page 17 of the presentation materials, the note states that the liquidation portion of mortgages is excluded, but I would like to know the past track record of liquidation and your thoughts on what kind of policy you intend to pursue.

Although details are not disclosed, the company has liquidated a cumulative total of about 700-800 billion yen in the past fiscal years as the amount of loans originated has been accumulating. This was done in response to cash management, responding to regulations on capital adequacy ratios, and other factors, and is shown as a deduction from the balance. Now, the company's capital adequacy ratio and financial base are stable, and no such action is expected in FY24-03.

-

Questioner 5

-

-

You mentioned that 10% of KDDI consolidated operating income will be earned from the finance business, but could this reach the level of a quarter within the next 10 years? Also, looking a little further ahead, what growth drivers do you see?

You mentioned that 10% of KDDI consolidated operating income will be earned from the finance business, but could this reach the level of a quarter within the next 10 years? Also, looking a little further ahead, what growth drivers do you see?

The total consolidated profit will be over 1 trillion yen, 10% of which will be over 100 billion yen. We are currently seeking a profit of 32 billion yen for FY24-03, and it will take some time to reach over 100 billion yen, although it is not far away. I would like to leave it as a bit of future homework to reach a quarter.

Growth drivers are Banking and Credit card. Particularly for Credit cards, we expect to expand revenues from highly profitable gold cards and from financing such as revolving and installment handling fees in line with the increase in shopping usage. Regarding banking, we would like to pursue a model of increasing the interest margin on total assets by expanding the balance sheet and balancing deposits and loans.

-

-

-

Rakuten has its finance business be listed on the stock market separately. Does KDDI have any plans to do so?

Rakuten has its finance business be listed on the stock market separately. Does KDDI have any plans to do so?

Now, we are not considering going public or spinning off the company.

-

- Other IR Information

Investor Relations

E-mail Alerts

- KDDI IR Official Twitter

- Recommended Contents

-