The Source of KDDI's Value

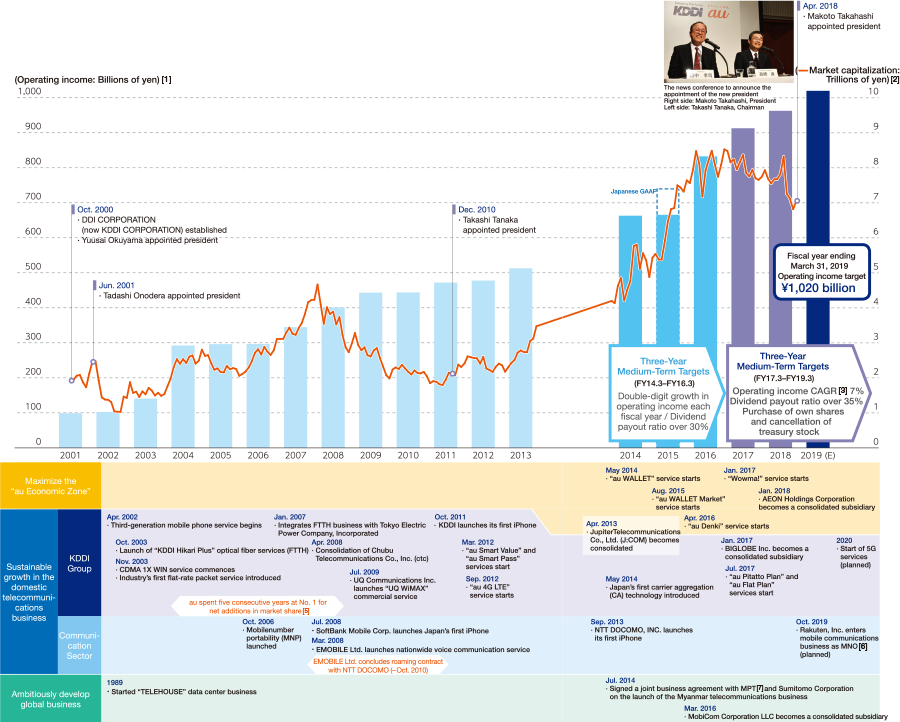

Since its establishment in October 2000, KDDI has leveraged its strengths as a comprehensive telecommunications carrier to continue growing its business. In terms of the three-year medium-term targets that concluded in the fiscal year ended March 31, 2016, operating profit experienced double-digit growth in each fiscal year in addition to the strengthening of shareholder returns and greatly expanding corporate value.

KDDI is currently taking steps to achieve medium-term targets that will conclude in this fiscal year, such as an average annual operating income growth rate (CAGR) of 7% and a dividend payout ratio over 35%.

- Retaining a strong customer base inside and outside Japan

(As of March 31, 2018)

- Touchpoints both online

and offline

(As of March 31, 2018)

- A history of actively promoting industry-first services and original KDDI initiatives since our launch

- October 2003

Sales commence of "INFOBAR," the first model from the au Design project - March 2012

Launch of "au Smart Value" and "au Smart Pass" - July 2017

Start of "au Pitatto Plan" and "au Flat Plan"

- No. 1 in brand strength and customer satisfaction and in both corporate and individual services

![J.D. Power No.1 in Mobile Phone Service Satisfaction for two years [8]/ (UQ mobile) J.D. Power No.1 in Low-cost Smartphone Service Satisfaction [9]/ J.D. Power No.1 in Business Mobile Phone Service Satisfaction Large Corporations/Medium-sized Enterprises Market Segment [10] for two years](http://media3.kddi.com/extlib/english/corporate/ir/ir-library/annual-report/2018-selected/value/index/img_08.jpg)

- Other IR Information

- Recommended Contents

-