- KDDI HOME

Corporate Information

Corporate Information  Investor Relations

Investor Relations  IR Documents

IR Documents  Integrated Report

Integrated Report  Selected Pages of Integrated Report (2018)

Selected Pages of Integrated Report (2018)  The Source of KDDI's Value

The Source of KDDI's Value

The Source of KDDI's Value

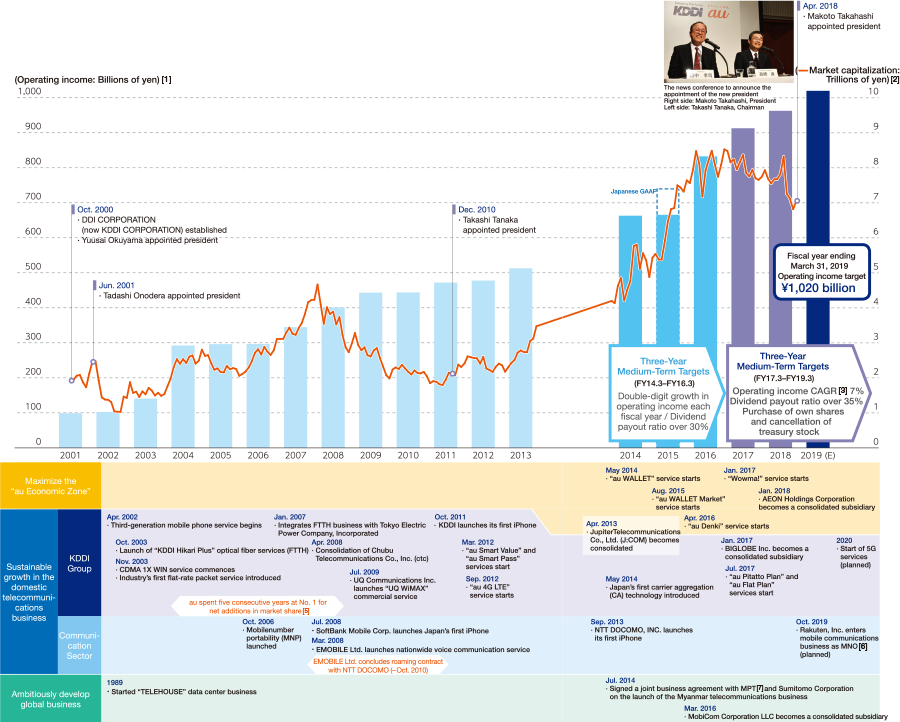

Since its establishment in October 2000, KDDI has leveraged its strengths as a comprehensive telecommunications carrier to continue growing its business. In terms of the three-year medium-term targets that concluded in the fiscal year ended March 31, 2016, operating profit experienced double-digit growth in each fiscal year in addition to the strengthening of shareholder returns and greatly expanding corporate value.

KDDI is currently taking steps to achieve medium-term targets that will conclude in this fiscal year, such as an average annual operating income growth rate (CAGR) of 7% and a dividend payout ratio over 35%.

- Retaining a strong customer base inside and outside Japan

(As of March 31, 2018)

- Touchpoints both online

and offline

(As of March 31, 2018)

- A history of actively promoting industry-first services and original KDDI initiatives since our launch

- October 2003

Sales commence of "INFOBAR," the first model from the au Design project - March 2012

Launch of "au Smart Value" and "au Smart Pass" - July 2017

Start of "au Pitatto Plan" and "au Flat Plan"

- No. 1 in brand strength and customer satisfaction and in both corporate and individual services

![J.D. Power No.1 in Mobile Phone Service Satisfaction for two years [8]/ (UQ mobile) J.D. Power No.1 in Low-cost Smartphone Service Satisfaction [9]/ J.D. Power No.1 in Business Mobile Phone Service Satisfaction Large Corporations/Medium-sized Enterprises Market Segment [10] for two years](http://media3.kddi.com/extlib/english/corporate/ir/ir-library/annual-report/2018-selected/value/index/img_08.jpg)

- Other IR Information

Investor Relations

E-mail Alerts

- KDDI IR Official Twitter

- Recommended Contents

-