CFO Message

Corporate "Sustainable Growth" and Solutions for Social Issues

The COVID-19 pandemic completely upturned the day-to-day lives we had taken as a given and, due to this, many social issues were brought to the fore, including Japan’s lagging digitalization.

The key to resolving these issues is enhancing telecommunications and technologies. To realize Society 5.0, KDDI is implementing various initiatives with its partners. Everything will be connected through 5G and IoT in this more resilient society, which will utilize big data and AI extensively. In collaboration with many regional municipalities, we are working on solutions, for example, to such issues as smart agriculture and smart fishing utilizing IoT, to achieve the sustainable development of regions and cities. We will contribute to building a sustainable society by continuing to provide new added value to customers and society based on big data collected by IoT.

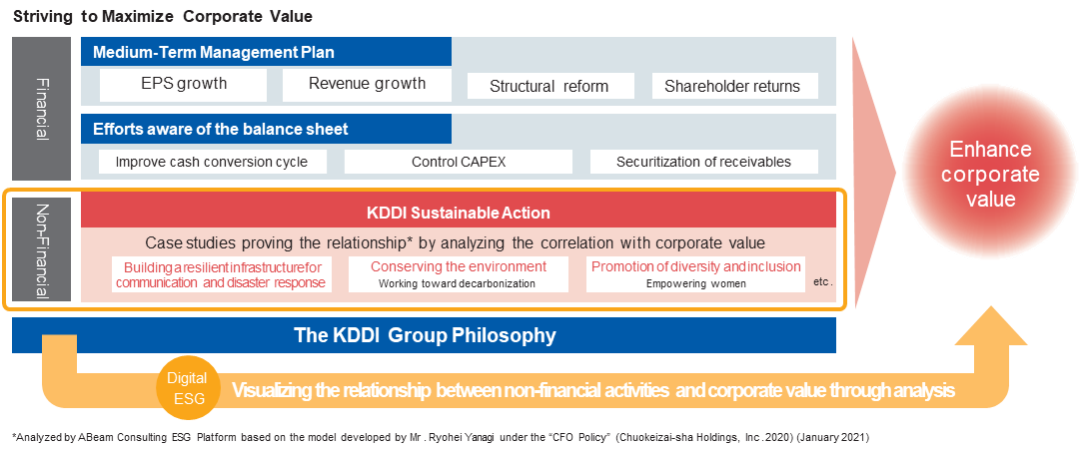

Under the medium-term management plan (April 2019 – March 2022), KDDI clarified the relationship between the business plans of each department and the SDGs. Going forward, we aim to maximize corporate value by working hard to solve social issues through business.

KDDI Sustainable Action for 2030

KDDI’s Three Types of "Connecting"

For KDDI’s target SDGs, we clarified that we are connecting three ways:Connecting and protecting lives, Connecting Day-to-day Lives, and Connecting hearts and minds.

Under "Connecting and protecting lives," we will build safe and reliable telecommunications infrastructure in preparation for intensifying large-scale natural disasters. Under "Connecting Day-to-day Lives," we provide affordable, high-quality telecommunications services that serve as the foundation of economies in developing Asian countries, thereby supporting people’s lives. Under "Connecting hearts and minds," we promote initiatives related to supporting women and LGBTQ as a way to respect diversity as well as education to increase children’s IT literacy and enable them to properly and safely use smartphones.

KDDI’s Three Types of "Connecting"

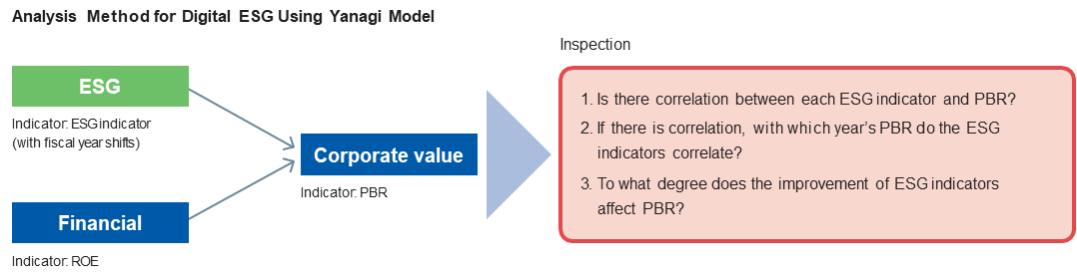

Visualizing Non-Financials

We will promote KDDI Sustainable Action and undertake Digital ESG, for which we conduct practical data analysis of the relationship between non-financial activities and corporate value.

Enhancing Cost Efficiency Accompanying Structural Reform

Under the current medium-term management plan, we aim to enhance cost efficiency by ¥100.0 billion over three years. The pillars of this effort are enhancing the efficiency of marketing as well as optimizing and enhancing the efficiency of network operations. We will give our best to undertake structural reform.

Cash Allocation and Shareholder Returns

Underpinned by the strong financial base and high cash flow generation ability, we prioritize growth investments for sustainable growth, conduct M&A centered around strengthening service capabilities in growth fields, and carry out capital investment centered around 5G.

In addition, as for shareholder returns, we set a target of a dividend payout ratio of over 40% and dynamic share buybacks.

In Conclusion

We aim to achieve sustainable growth and enhance shareholder returns by informing management with the valued opinions gleamed from dialogue with shareholders and investors as well as the changes in behaviors of consumers who choose products and services from a perspective not limited to economic rationality or convenience.

Financial Results Summary

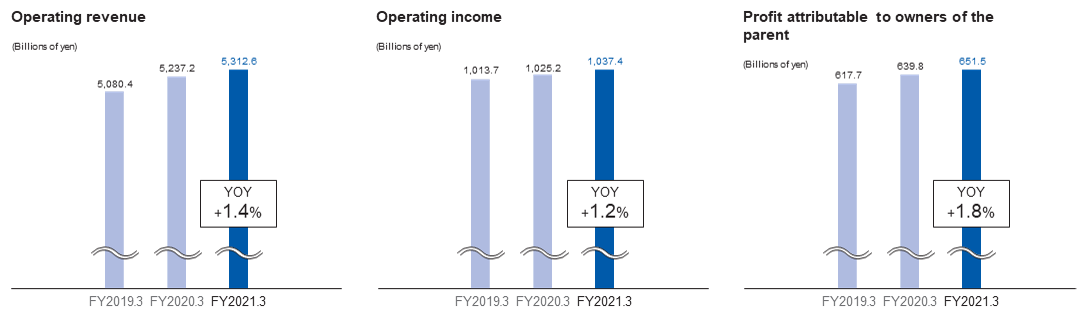

Consolidated Financial Highlights for FY2021.3

Consolidated operating revenue was ¥5,312.6 billion, up 1.4% year on year. Consolidated operating income was ¥1,037.4 billion, up 1.2% year on year, driven by higher income, especially in growth fields, despite lower revenue from telecommunication revenues. Profit attributable to owners of the parent was ¥651.5 billion, up 1.8% year on year.

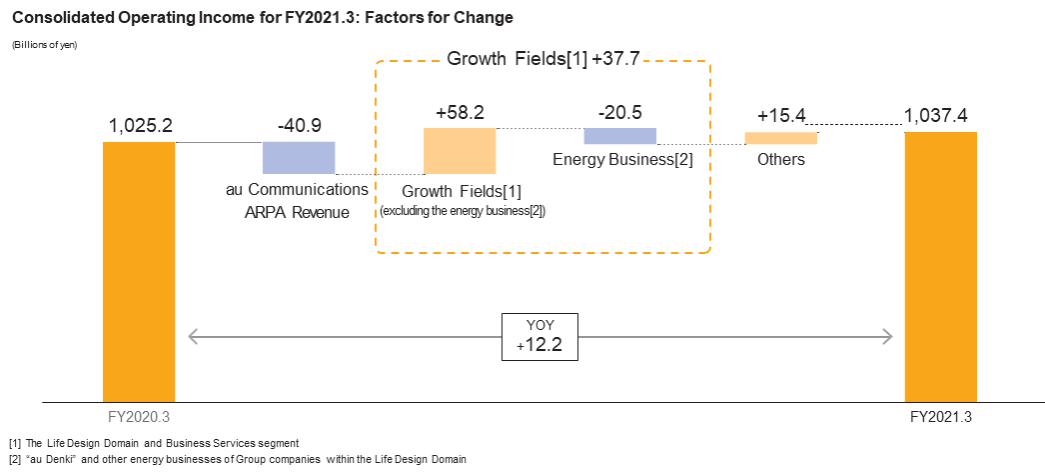

Operating Income: Factors for Change

Although au communications ARPA revenue was negative, higher income in growth fields drove financial results with the settlement and financial fields in the Life Design Domain driving profit growth and the Business Services segment steadily seizing teleworking and DX demand. However, income in the energy business fell ¥20.5 billion,

which we interpreted as a temporary effect while we implement measures to procure electric power sources going forward.

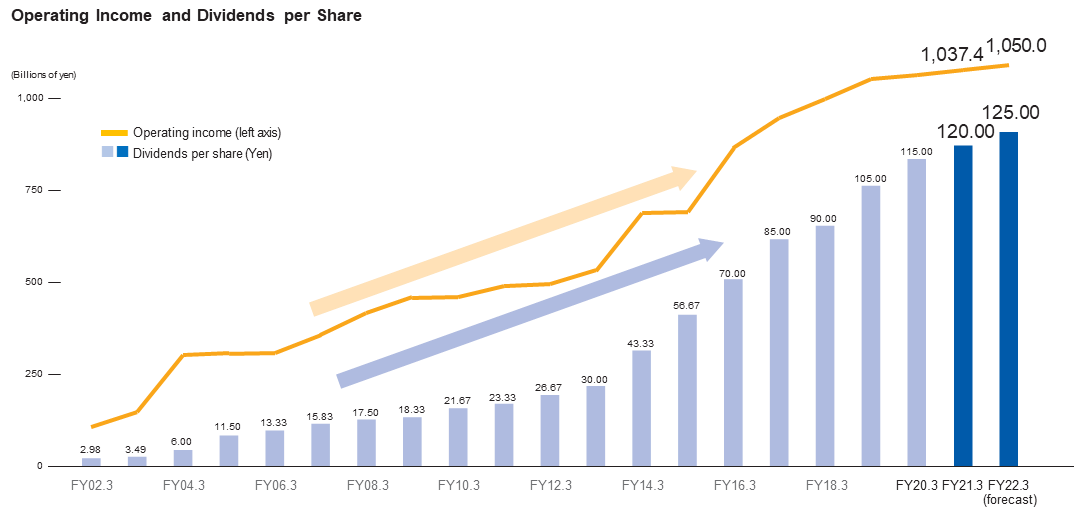

FY2022.3 Consolidated Operating Results Forecast

We expect consolidated operating revenue of ¥5,350 billion and operating income of ¥1,050 billion. Although we are expanding the number of Group IDs, we forecast revenue depressing effects due to lower Multi-Brand communications ARPU in line with a lowering of telecommunication revenues and will record costs related to the suspension of 3G, as well as expenses to achieve further growth. Nevertheless, we aim to increase income on a consolidated basis by covering a decrease in revenue with roaming income in addition to generating profit mainly through the further expansion of strong growth fields and cost reductions accompanying structural reforms.

Shareholder Returns

Dividends per share in the fiscal year ended March 31, 2021 stood at ¥120 for the year (dividend payout ratio: 42.2%), a ¥5 increase year on year. The forecast for the current fiscal year is an increase of ¥5 to an annual dividend of ¥125, aiming for an increase in dividends for 20 consecutive fiscal years.

In addition, in line with steadily enhancing shareholder returns, we announced share buybacks of ¥150 billion in FY2022.3.

- Other IR Information

Investor Relations

E-mail Alerts

- KDDI IR Official Twitter

- Recommended Contents

-