- KDDI HOME

Corporate Information

Corporate Information  Investor Relations

Investor Relations  IR Documents

IR Documents  Integrated Report

Integrated Report  Integrated Report 2019 (Online Version)

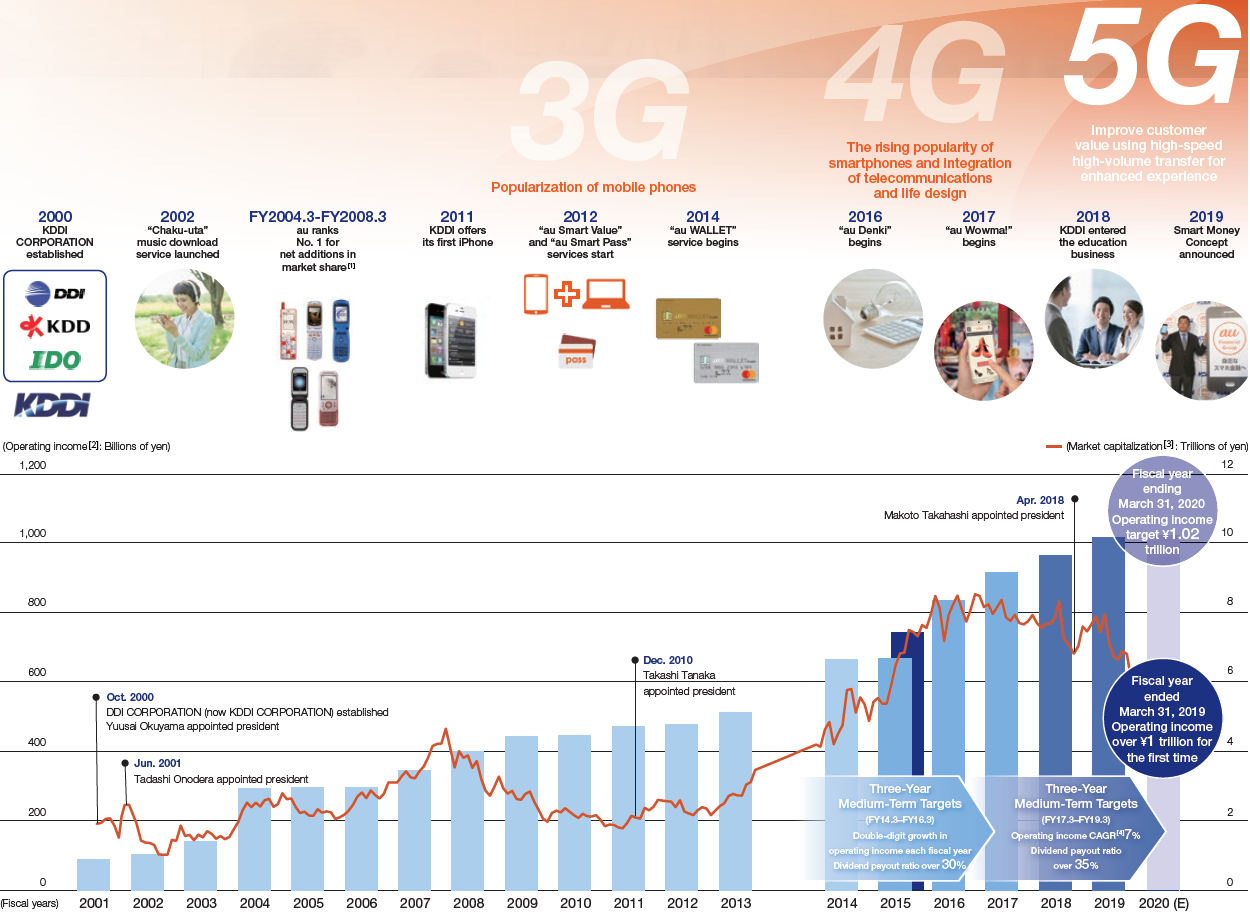

Integrated Report 2019 (Online Version)  The Path of Value Creation

The Path of Value Creation

The Path of Value Creation

- Retaining a strong customer base inside and outside Japan

(As of March 31, 2019/Personal Services Segment)

- Touchpoints both online and offline

(As of March 31, 2019)

- Develop new pricing plans ahead of the industry

- No.1 in brand strength and customer satisfaction and in both corporate and individual services

![J.D. Power "No. 1 in Mobile Phone Service Satisfaction" [6] for three years/(UQ mobile) J.D. Power "No. 1 in Low-Cost Smartphone Service Satisfaction" [7] for two years/J.D. Power "No.1 in Business Mobile Phone Service Satisfaction" (Large Corporations/Medium-Sized Enterprises Market Segment) [8] for three years](http://media3.kddi.com/extlib/english/corporate/ir/ir-library/annual-report/2019-online/value/index/img_08.jpg)

KDDI's Value Creation Cycle

The four sources of KDDI's value are its "customer base," "touchpoints," "innovativeness," and "brand strength" that have been built over the years since its establishment. We will further refine and enhance these sources of value and optimally allocate the Company's management resources to maximize KDDI's corporate value. In doing so, we aim to achieve our medium-term management plan for the fiscal year ending March 31, 2022.

KDDI's Surrounding Business Environment

Political (Government/Legislation)

- Comprehensive verification of competition rules in the telecommunications business field

- Complete separation of telecommunication fees and handset prices

Economic

- Consumption tax hike, expansion of cashless settlement

- Development of economic and social infrastructure for the Tokyo Olympics

Social (Society/Culture)

- Declining birth rate and aging population/Shrinking population

- Decrease in local labor force, Regional revitalization

Technological

- 5G service starts

- Development of technologies such as IoT and AI

- Accelerating use of big data for a data-driven society

- Strengthening measures against cyber terrorism

Customers (Market/Clients)

- Further popularization of smartphone use

- Expansion of sharing

- Expansion of fintech market

- Diversification of SNS

Competition

- Entry of new business operators into MNO [9] and price competition

- Expansion of business to fields beyond telecommunications

- Accelerate collaboration with partner companies for 5G

- Homogenization of services offered by mobile companies

- Integrated Report 2019 (Online Version)

- Interview with Management

- Realizing Sustained Growth and Medium- and Long-Term Improvement in Corporate Value

- The Path of Value Creation

- Risks and Growth Opportunities

- Medium-Term Management Plan (FY2020.3-FY2022.3)

- Special Feature: Aiming for a New Stage of Growth

- The Integration of Telecommunications and Life Design

- New Growth Opportunities and Solutions for Social Issues with 5G

- Business Expansion through Collaboration with Partners

- Messages from Outside Directors

- KDDI's Sustainability

- Activities by Segment: Personal Services Segment

- Activities by Segment: Life Design Services Segment

- Activities by Segment: Business Services Segment

- Activities by Segment: Global Services Segment

- The Japanese Market and KDDI: Characteristics of the Domestic Market

- The Japanese Market and KDDI: KDDI's Domestic Status

- Other IR Information

Investor Relations

E-mail Alerts

- KDDI IR Official Twitter

- Recommended Contents

-